In This Article

Do you need real-time visibility into your financial data to make critical decisions fast? Consider digitizing record-to-report (R2R) to make this happen.

According to the latest market trends, businesses are now more inclined to adopt cloud-based accounting rather than on-premise accounting. So, digital record-to-report has become necessary for them.

A Record-to-Report (R2R) process helps financial managers make important financial decisions. It involves collecting, processing, and presenting financial data accurately.

Hence, R2R plays an important role in an organization, which can further maximize the ROI. Digitizing this process is a must. Let’s talk about more about this in this blog.

How Important the R2R Process Is?

The R2R process provides a clear image of the financial standing of an organization. Financial managers can track the following things from this process;

With all this information, financial managers can measure financial performance, stay compliant with regulatory requirements, and most importantly, they can make strategic financial decisions.

But wait!! There are a lot more things you can do when you consider digitizing it. For eg,

Making Quick Decisions

Get real-time visibility of your financial data through the R2R process. Digitizing this process means you’re connecting multiple sources into it. From profit & loss statements to processing cost calculations, everything gets incorporated into it. After digitization of your documents, managers don’t need to open each of the documents to check. All they can see is a dashboard representing data from all these documents in real time.

Closing Books Quickly

Working with R2R digitization provides a flow into the operations. It helps in solving complex reconciliations and simplifies integrations. With R2R, accountants will have more time on the data analysis rather than wasting time on compiling data multiple times. Besides digitizing R2R, you can outsource bookkeeping services to manage your accounting tasks professionally. Closing books on time can also give you an edge in reducing errors and latency.

Stay Compliant

Following the accounting standards and regulations is extremely important to stay compliant. The digital record-to-report system brings automated audit trials internally into the financial process. So, it removes issues like inconsistencies, inaccuracies, gaps in accounting data, and many other things. Plus, it takes care of documentation needs to facilitate external audits and also minimizes compliance risks.

Steps Involved in Digitizing Record-to-Report

Simply put, the term “Record-to-Report” is a combination of two words; one is “Record” and another is “Report”. As the name suggests, the process is all about some records which you need to report. In this process, we visualize the accounting records to make key financial decisions. It involves many critical steps, which are

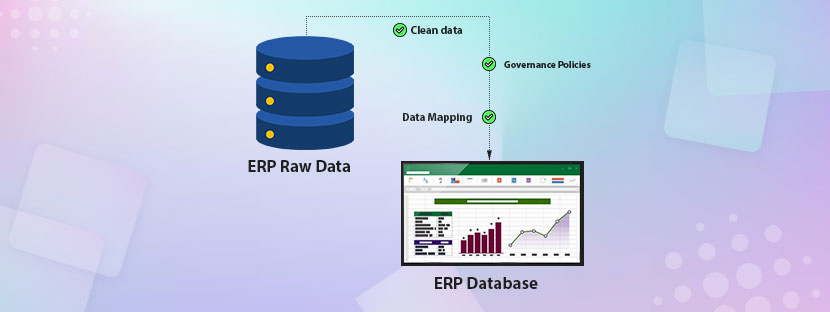

I. Data Collection

Collect data from different sources like invoices, transactions, bills, or any other financial document. This process involves only collecting the financial data that organizations take into their accounts. Collecting financial data while following a rule helps to get relevant information from some selected sources, which is more than sufficient for processing.

II. Data Entry

Now comes the main part, you need to put the collected data into the accounting system like data entry. Starting from journal entries, you need to categorize expenses and record them in the financial process. Overwhelmingly, correct data entry is mandatory in this step; otherwise, it can show distorted results.

III. Data Verification

Verifying each accounting record is mandatory to complete the reconciliation process. To verify each set of accounting records, you need to cross-check your data against bank statements and other documents that you have as support. The goal of the verification must be to make the financial information crisp, accurate, and free from silly errors.

IV. Ledger Management

Balance all accounts that you have with the integration of accurate ledger management. It ensures that all transactions are accurately categorized and then recorded. Not only accounts are balanced but this process keeps accounts up-to-date.

V. Account Closing

Consider the closing of accounts at the end of each accounting period. Thus, you need to be ready with the closing date. For that, preparing month-end, quarter-end, and half-yearly financial statements is essential.

VI. Data Consolidation

Preparing a single set of financial statements after collecting data from other departments is data consolidation. Organizations having multiple business units or different entities must prepare consolidated financial reports at the end.

VII. Financial Reporting

The Record-to-Report process takes out data directly from financial statements. Hence, preparing the financial reports is the key step involved here. Through financial reporting and its insights, R2R reveals the actual financial condition of the company to all stakeholders.

Insights about R2R Digitization in the Future

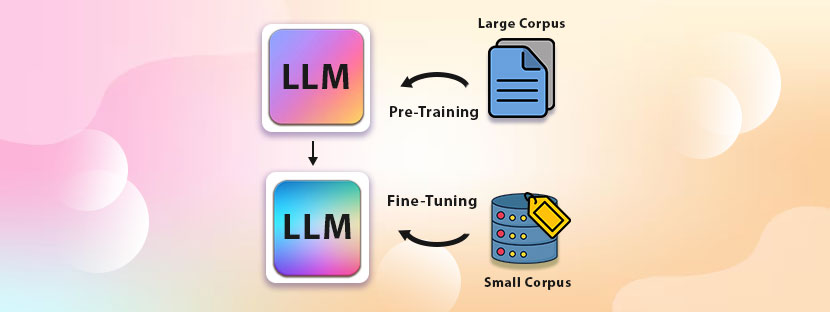

Artificial Intelligence (AI) and Machine Learning (ML) both these technologies will dominate the future of the accounting process. With the integration of these technologies, the system will become automated, and they’ll eliminate mundane manual work from the roots. When the heavy manual work is deleted from the process, it will let the accounting team focus on high-value analysis and planning. All these processes demand digitizing record-to-report and that is the most essential thing.

On the other hand, data analytics will going to play a significant role in the accounting domain. It will break each data point into smaller elements and help the accounting team assess their financial decisions closely. Digital record-to-report processes, powered by AI, will transform financial operations from the core.

It’s high time to digitize record-to-report to welcome the upcoming changes in the industry.

Financial document digitization is the key to success in the coming years. Many organizations have already shifted their process to the digital sphere and enjoying the seamless movement of their financial data. Digitizing record-to-report and adopting new technology are impacting the accounting model on a deeper level.

How R2R Digitization Impacting the Accounting Model

Final Words

It’s the digital era where we are all living. From finance to other business process, everything is available digitally. So, digitizing the record-to-report process is a rational need and you must do it. If your team is efficient enough to initiate the change then you can go for that. Otherwise, outsourcing can help here.

For your reference, AskDataEntry has been handling bookkeeping and data entry operations for the last 10 years. You can also outsource your requirements from here. If so, feel free to connect with us, we’ll be happy to help you.