Purchasing goods on credit is a common phenomenon in business. All credits are maintained in accounts payable (AP) or balance payable accounts. At the end of the year, accounts payable auditors check the balance and compile accounting statements. Auditing AP regularly fetches unfavorable benefits to businesses.

In this blog, I will tell you how an AP auditor can help your business stay financially compliant and manage vendor payments. Let’s get it started!

Before we start, let’s have a glimpse of AP auditing and understand what it actually means.

What Accounts Payable Auditing Indicate?

Auditing, in simple terms, basically means inspection. It’s an inspection of accounting records to check all transactions are placed methodically as per the accounting framework. Professional auditors generally perform all auditing tasks to keep accounting tasks in check. Note that auditing tasks vary from country to country as per the financial laws and regulations. Governments across the countries especially focus more on tracking business finances via the auditing process.

Anyway, AP auditors are exclusive professionals who manage accounts payable checking. They check whether your business’ payables are documented properly and whether all records showcase your business liabilities. More than that, auditing ensures that all your company’s resources are being used for legitimate purposes.

You must hire an accounts payable auditor for the following purposes;

- Your bills are getting paid regularly on time

- Prevent generating and processing duplicate files

- Less chances of unrecorded liabilities

- Avoid getting vendor payment defaulting incidents

What to Check Before Planing for Account Payable Auditing

If you have planned to bring an auditor to check AP tasks then you have to prepare your accounting data first. Usually, auditors do not follow a specific set of formulas to check all your financials. They just pick random staff from scratch and start their inspecting tasks. So, it’s recommended to be prepared with all your data in hand while working with the auditor.

Start with understanding the accounts payable auditing procedure;

Mainly, there are four stages involved in this process where you have to consider each step consciously to ensure accuracy in accounts payable. Let’s discuss all stages here;

Planning

Before the actual auditing process starts, planning out everything is a must. First, let your AP auditor discuss the scope and possibilities of your auditing process. Therefore, you can plan the entire auditing process accordingly.

While planning, you can discuss concerns regarding your AP process, financial conditions, vendor payments, etc. Discussing all these matters with auditors will help you prepare the action plan in which you can start the fieldwork.

Fieldwork

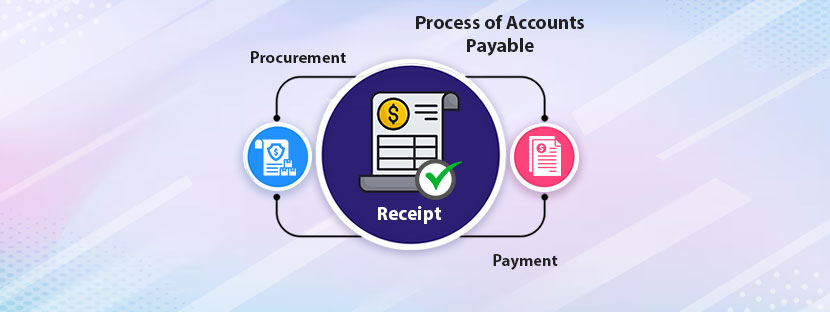

The actual auditing starts with the fieldwork when your accounts payable auditor takes action. Starting with the review of your business functions, he can check and examine all your business transactions and documents. The documents include;

- Purchase Order

- Vendor Invoices

- Bank Records

- Journal Entries

- Cash Payment Receipts/ Memos

Note: you need to ensure all your documents are arranged in proper order to get the auditing process completed perfectly. Many companies outsource bookkeeping data entry work to manage their accounting data on the right track. It’s one of the best ways to ensure the complete accuracy of data without spending time and money on it.

Performing fieldwork can take a few hours to a few days, it completely depends on the load of the work. If the size of your business is big then it would take more time compared to a small business where it would take much less time. The thing is the auditor will check all transactions so big businesses have greater transactions than small businesses.

Audit Report Generation

Once the fieldwork is completed, the next process is to put all findings into a report. Your accounts payable auditors prepare the report considering your business’s financial status. The report will contain the performance of your business’s accounts payable and showcase how compatible it is.

Further, the report also details where your business is doing well and where it can improve more. Based on the audit report, your accounting team can take the next move to process financial matters. That’s why you must take the utmost consideration while assessing the audit reports.

Follow-Up Review

Wait, the process of AP auditing is not over yet. After recommending necessary changes in your AP system, your AP auditors take follow-up measures. They check whether your business has successfully implemented the process or not. If you implement their recommendation then your business process can smoothly run and bring wonders later.

Let us help your AP auditor with accounting data.

From processing invoices to handling your bookkeeping tasks, AskDataEntry can genuinely help you. We have been working on this domain for the last 9 years with an amazing track record. You can try us to make your financial data ready for AP auditing and of course, for other financial work.