In This Article

Managing a business sometimes gives you overwhelming experiences, particularly when it grows and explores new dimensions. Any complication regarding financials can make the scenario even worse. Let’s not take that risk. We’ll look for affordable bookkeeping and tax compliance for Australian companies in this blog to help you manage your financial matters.

But, Why Looking for Bookkeeping?

Bookkeeping is the first step of the accounting process. Good bookkeeping acts as the backbone of any successful organization. Bookkeeping is the ultimate process that ensures all your accounting information is in the right place and helps you prepare the financial statements at the end of the financial year.

Bookkeeping records and organizes financial transactions for day-to-day business operations. From recording every sale you make to each tax you consider, it covers everything. Without having standard bookkeeping practices in your financial process, sustaining your business’s financial journey will be tough in the long run. Hence, bookkeeping is the right thing that every organization must do carefully and cautiously for a better financial outcome.

However, bookkeeping practices for your business must be compliant with Australian regulations. That’s the basic. Anyway, looking for affordable bookkeeping and tax compliance for Australian companies is beneficial when you know the core reasons; which are;

Reasons Why Outsourcing affordable bookkeeping and tax compliance for Australian companies Makes Sense

Often business owners make mistakes in identifying bookkeeping practices. They think accounting and bookkeeping same. But, they are not the same. Bookkeeping is something different. It’s the initial stage where you shape your financial data. For example, a professional bookkeeper will record the financial data in your accounting system. Later on, your accountant will validate the record and give the final touch to the financial statements.

There are many reasons why you must outsource bookkeeping services made exclusively for Australian companies. However, we will be going to discuss only the relevant points here.

Make Tax Preparation and Filing Easier

Australian companies have to submit quarterly and monthly taxation reports to the Australian Taxation Office (ATO) mandatorily. Timely submission of tax reports to the ATO is a big thing and you cannot mess with it. Right? Hiring a professional agency for bookkeeping services can professionally help you here.

Bookkeepers will ensure that all your tax-related documentation is running smoothly in order and on time. So you can file your tax files to the ATO and get timely returns.

Daily Transaction Reporting & Recording

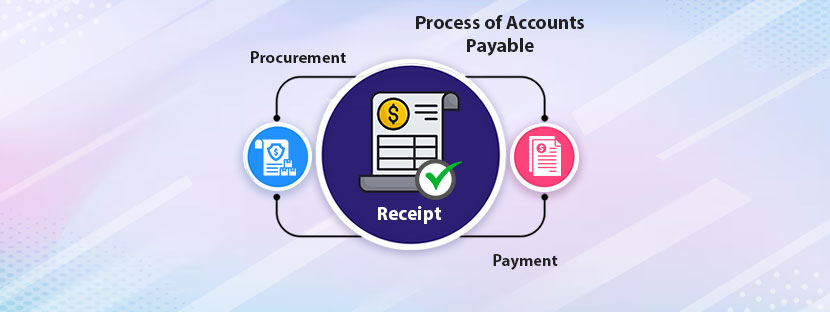

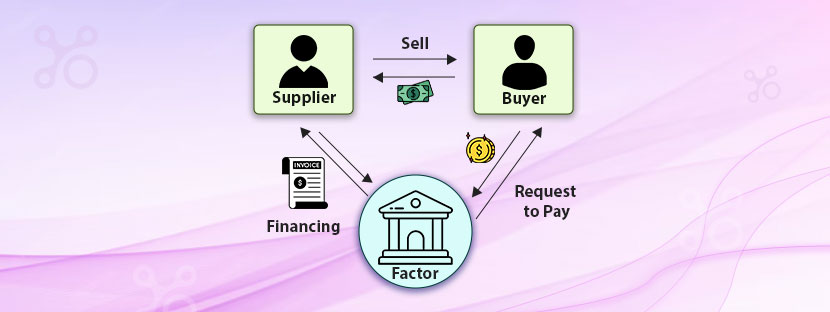

Bookkeepers record all transactions on a daily basis, ensuring that all income and expenses are documented correctly. They will follow and use the right format to record every single transaction for your financial accounts.

Match Bank Reconciliation

This service ensures that your business’s bank statements match your financial records, helping to spot discrepancies and avoid fraud. A bookkeeper helps minimize errors in financial reports and they reconcile each financial record carefully.

Payroll Management & Due Clearance

Bookkeepers can manage employee payroll, ensuring that wages, deductions, and superannuation contributions are paid accurately and on time. If you think differently, paying dues on time always builds up your business and helps you to gain a reputation.

Financial Statements

Professional bookkeepers prepare key financial statements, such as balance sheets, income statements, and cash flow statements, to provide a snapshot of your business’s financial health. They have specialized knowledge and experience in handling bookkeeping tasks for various industries. They can ensure that your financial records are accurate and compliant with Australian laws.

Some Little Advise

In the ever-evolving business environment in Australia, staying on top of your finances is crucial for long-term success. Through affordable bookkeeping and tax compliance for Australian companies, you can streamline your financial management, reduce errors, and ensure compliance with Australian regulations. When you choose bookkeeping outsourcing services, finding the right provider will allow you to focus on what matters most—growing your business.

With the right bookkeeping services provider, you can ensure that your finances are well-managed, your records are accurate, and your business is on the path to success.