Managing outgoing cash flow is utterly important for you. It does not matter whether you own a start-up or a big tech company. Following up on all the accounts payable procedures, along with all the minute stuff, is important.

With the coming up of hyperautomation technology, AP (Accounts Payable) automation has become a regular thing. Companies are gradually accepting automated software to manage their AP processes. However, to perform the AP tasks via software, you need a complete understanding of how the actual Accounts Payable thing works.

Welcome to this blog. Here, we will understand the core elements of accounts payable procedures and also try to simplify all the processes. So that you can follow each step accurately and automate your AP process if you want to.

Let’s start.

Understanding the flow of accounts payable procedures

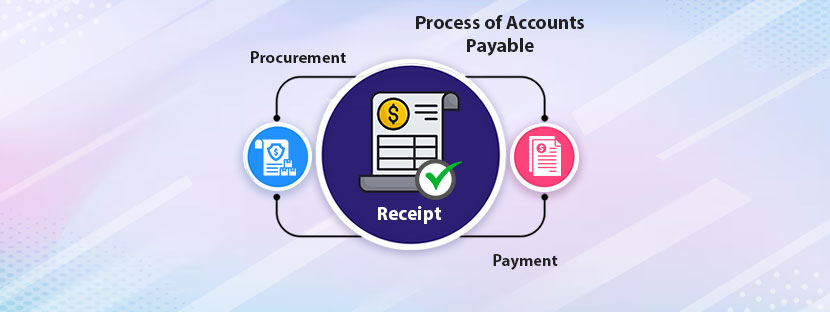

Starting from receiving invoices to paying vendors on time, perfectly managed accounts payable is essential for any business. It works in a cycle, and sometimes it is called full cycle accounts payable. Basically, it means an accounts payable department has to go through a complete cycle to archive a purchase.

It’s a flow, not a fixed concept. Overall, the accounts payable procedures can be categorized into;

Following up on each step of accounts payable is important because it ensures the business pays off its debts at the right time. Not just adding payment reminders, the AP process organizes payment plans and helps boost the confidence of the creditors in your business.

One of the key areas where your team may be facing delays is invoice processing. It’s a part of the accounts payable process. Getting approvals on time matters the most in invoice processing. Verifying invoices and paying out to vendors on the right time comes under the job of AP processing.

All the tasks, from invoice capture to invoice verification, accounts payable procedures undermine everything. Nowadays, bookkeeping software also handles AP work. It eliminates speeding up the AP workflow and allows your AP team to focus on the growth that your business deserves.

Importance of accurate management of accounts payable procedures

An excellent management of accounts payable is essential to achieve business success. A stable AP process is something beyond just paying the bills. It’s more about managing the operation, maintaining vendor relationships, and keeping the cash flow cycle healthy. AP mismanagement can lead to late payment issues, data errors, and strained vendor relationships. That’s why accurate management of AP procedures is highly valued. The reasons are;

Building Strong Vendor Relationships

Purchased products on credit have to be paid before the due date. Paying vendors on time is the responsibility of every business. It helps build trust between the business and the vendor, plus it strengthens over time. On the contrary, a minimal delay in payment release can easily frustrate vendors. Over time, it can lead to major issues or even it can go further into contract termination.

Error Reduction and Accuracy Enhancement

The issue of double payment is not new in the AP system. It happens when your AP team sends payments without verifying the payment information in multiple rounds. However, with ethical follow up of accounts payable procedures, payment errors can be minimized and later on, eliminated. Following up on the KPI of accounts payable also helps prevent costly mistakes like overpayments. It can guide you in matching invoices, purchase orders, or receipts with accurate information.

Better Cash Flow Management

Organized accounts payable help control workflow better and allow businesses to control cash operations. Invoices must be paid before the due date but not too early. Sometimes, businesses need to hold cash for better cash flow. Releasing payments before the date can negatively affect cash flow. Thus, maintaining flexibility in the cash operation is important for business growth. Some liquid cash should be kept aside to meet unexpected expenses.

Preventing Late Fees

Vendors usually offer discounts to get their payments before the due date. On the other side, they charge late fees for paying them late. So, the aim should be to get the maximum discounts while avoiding late fines. Excellent management of the AP procedures keeps a balance between both concepts. Thus, you can get the maximum benefit in the long run.

On-Time Compliance

Compliance with financial regulations is extremely important for smooth accounts payable to operate. Accurate management of all payments, invoices, and approvals makes it easier to comply with all laws and taxation policies. Basically, it builds transparency in the payment flow as well as reduces audit risks. Building up solid financial integrity through the process is possible.

Components of accounts payable procedures

Accounts payable is a systematic as well as a lengthy process, and it covers different matters altogether. If we consider the full cycle of the accounts payable process, we can describe the process into the following components;

Purchase Order Issued

The journey of AP starts with the issuance of purchase orders or POs. A purchase order is sent to the vendor as it is the formal version of sending the vendor what you require. All the necessary details like your purchase items, quantities, payment terms, pricing, etc must be mentioned in the purchase order. This will lay the groundwork for the accounting payable process to start with.

Invoice Receipt

Following the accounts payable procedures, the supplier or the vendor must send you a paper or electronic invoice. Once you get the invoice, you need to immediately enter the invoice data into your AP system. You can choose to enter the data manually or using any automated system. Nowadays, many companies are choosing AI-enabled applications for automating their invoice receipts.

Using these application is quite easy. These tools or applications use Optical Character Recognition (OCR) technology to extract data from PDFs and other format digitally. After data extraction, it sends the data directly to the database for the AP team to access it when needed.

Goods or services receipt

After getting the invoices, goods, and services (whatever you ordered) get released. The vendor prepares the order after getting the PO you sent. During the order confirming process, your AP team must monitor the process closely to avoid any misunderstanding. The goal here is to receive the items that align with your original order, which you have actually placed.

If you notice any discrepancy in between then you must raise it in advance. It would be best if you raised the matter before starting the invoicing process.

Invoice validation and document matching

After getting the invoice, it’s your responsibility to validate all information that the invoice contains. Invoice data must be similar to the purchase order. And if not, your AP team must raise an objection before your vendor. Proper verification of invoice data is important; otherwise, you might end up overpaying your vendors. That’s incorrect, right? So, you must always choose to validate invoice data before initiating the payment.

For document matching, you can follow either of the processes;

1. Two-way Match

Commonly, it’s a process to compare purchase orders and invoices. Checking each item from the list one after another is the core task in this process. You just need to compare your invoice data with the purchase orders.

2. Three-way Match

In this process, you need to check the delivery receipt, along with the purchase order and invoice. Ensure that the data across all these documents is the same. To do this, you need to check each document carefully and sharply.

Discrepancy redressal

Most of the issues are raised during the document-matching process. Immediate redressal of any thought is essential at this point when you are about to receive the purchase orders. Hence, your system must have a process to identify discrepancies and also initiate mechanisms to resolve them quickly. Some automated tools can help here identify discrepancies and redress them quickly.

Workflow approval

Each of the processes, starting from invoice generation to payment realization, needs a dedicated approval process or mechanism. Most of the companies rely on some dedicated applications to get the approvals. Based on predefined thresholds and authorization levels, each workflow will get approved accordingly.

Payment Authorization

Once the invoice gets approved, the payment gets initiated immediately. The payment approval process depends upon the urgency of the products. It means the business will pay off those invoices first, which goods and services they require urgently.

Payment processing

After payment authorization, now comes the payment processing part. For payment processing, a lot of things come in the way. It includes considering payment terms, discounts, preferred payment terms, and other factors. Nowadays, various payment applications are available that can handle payment processing part in better ways. You also use these applications if you are aware of the latest technology in AP payment processing.

Account entry

Now comes the most daunting task, which is entering all the records in the accounts. Whatever you have processed so far, you need to enter them into your accounting system. If your team is already engaged with a lot of important tasks, you can outsource these accounting entry tasks to any AP processing company for better results.

Payment reconciliation

After realizing all the payments, this business reconciles each payment with invoices as well as bank statements.

Vendor statement reconciliation

After all the process is done, the business goes back to the initial document, which is the purchase order first. It reconciles the purchase order with the invoice. Thereafter, the process ends with reconciling the vendor statement with AP records.

Roadblocks of accounts payable procedures

Like all the other processes, accounts payable also faces challenges and difficulties. These issues cost businesses time as well as money. So the sole focus here is to reduce the roadblocks and streamline the accounting payable processes. For that, highlighting the major challenges of AP is crucial. Let’s throw some light on them first.

Perform Manual Data Entry

Manual data entry is still practiced in many organizations due to a lack of awareness. Automated tools are widely used across organizations for entering data records. Well, manual data entry has some fundamental issues with it. Most commonly, manual data entry ends up making duplicate payment issues. The accounts payable procedures will get the best results when there are the least manual interventions.

As a solution to manual entries, adopting an automated AP processing system works best. Automated AP processing software takes power from the OCR technology as it can extract data from invoices directly. Plus, it can match invoices with other documents and simply overall performance.

Limited visibility

Tracking invoice status in real time is extremely important for the AP process. For that, the AP system must be transparent and have the highest visibility. However, with low or limited visibility in the AP process, you can only observe bottlenecks, and even you cannot monitor key performance indicators (KPIs). Missing payment deadlines and sub-optimal decision-making are also there.

Thus, real-time visibility is important in accounts payable procedures throughout. When you switch your AP process to any automated tool or software, it will become easy for you to track everything. You’ll get a dashboard mentioning all the aspects you need to track. So, you can check invoice status, approve workflows, measure KPIs, and many more things. Overall, you will get a transparent outlook of the AP system.

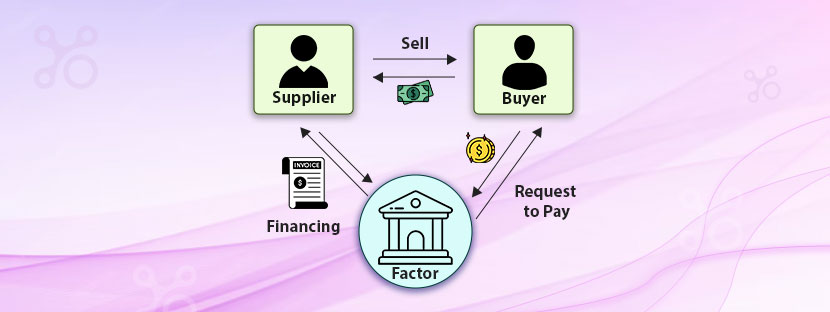

Supplier relationship management

Getting your required products delivered on time is the ultimate thing that you want from your suppliers. On the other hand, suppliers also expect to get their payments delivered on time from your side too. It’s a two-way communication model, which you need to manage through your AP team. Without having a dispute redressal mechanism, the roadblock will stay there forever and strain vendor relationships further.

To avoid this, the establishment of a strong communication channel is a must. Having a transparent communication channel will solve mismanagement issues and address all concerns whenever they are encountered.

Ways to simplify accounts payable procedures

Following up on each AP procedure carefully is important as it helps maintain your company’s financial agility. However, the AP process is quite a complex task and hence must be performed with the help of experts. To simplify AP management, nowadays companies are relying on accounts payable outsourcing for its elaborate benefits.

Through an outsourcing AP service provider, you can perform the following tasks;