In This Article

Are you a small business owner seeking ways to optimize your company’s financial efficiency in today’s competitive landscape? However, the question looms: how can Accounting Services for Small Business Boost Financial Efficiency?

Small business financial management can be intricate, and accounting services always offer solutions. In fact, the best accounting services for small businesses provide tailored financial solutions to ensure accurate records, informed decision-making, and then better economic efficiency. Meanwhile, real estate accounting services cater to the unique needs of real estate businesses, streamlining property management accounting, lease accounting, and then tax compliance.

However, automation, through automated accounting services, is always pivotal in saving time and reducing errors in financial processes. Subsequently, accounting services packages, customized to your needs, offer cost-effective solutions that maximize your resources. Simultaneously, cloud accounting services provide real-time access to economic data from anywhere, permitting you to create informed judgments on the go. Next, tax accountants for small businesses optimize tax benefits and compliance, boosting economic efficiency.

Definitely, virtual bookkeeping services streamline data entry and reconciliations while accounting and bookkeeping firms offer a comprehensive suite of financial services. Now, in this blog, we’ll discuss how these components collectively enhance economic efficiency, setting your small business on the path to success. Therefore, let’s dive in and explore the world of financial optimization and growth for small businesses.

Streamlining Financial Processes with Accounting Services for Small Business

Efficient financial control is obviously vital for the success and growth of any business. Undeniably, accounting services for small businesses aim to streamline financial processes, ensuring that they handle your company’s financial affairs precisely. Meanwhile, these services employ accounting professionals with the expertise to manage and organize your financial data effectively.

The Role of Best Accounting Services for Small Businesses

In today’s competitive business landscape, definitely, we cannot overstate the importance of efficient financial management. Surprisingly, small businesses, in particular, face unique challenges in this regard. In fact, to address these challenges, the role of accounting services for small businesses comes into play.

Moreover, this section will delve into the essential function of these services in tailoring financial solutions to meet the specific needs of small businesses. Besides, by providing customized financial support, these services ensure accurate financial record-keeping and informed decision-making, leading to increased economic efficiency.

Tailored Financial Solutions

Small businesses are not one-size-fits-all entities, and their financial needs can vary significantly. Yet, accounting services for small businesses recognize this diversity and provide tailored financial solutions. Thereafter, this tailored approach considers the specific requirements and goals of each small business, ensuring that it aligns financial management strategies with the business’s unique circumstances.

Access to Expertise

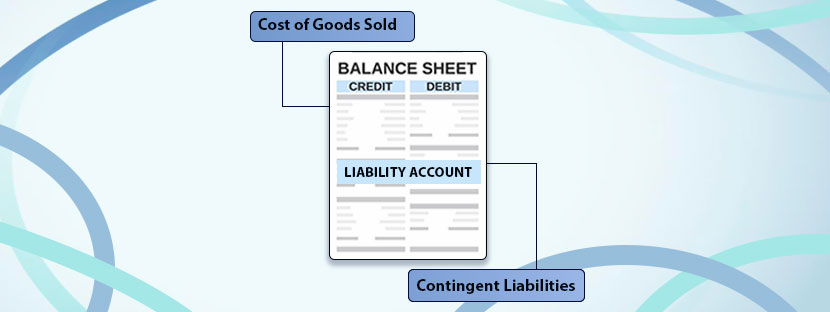

Surprisingly, accurate financial record-keeping is the foundation of any successful business. Hence, accounting services for small businesses offer access to expert professionals with the knowledge and experience required to maintain precise financial records. This expertise, however, extends beyond basic bookkeeping to include financial analysis, tax planning, and then compliance with regulatory requirements.

Informed Decision-Making

Informed financial decisions are crucial for the growth and sustainability of a small business. Meanwhile, accounting services provide the necessary data and insights that enable business owners to make decisions confidently. Consequently, these services go beyond just crunching numbers; they interpret financial data, identify trends, and offer recommendations, empowering small business owners to chart a path toward financial success.

Tracking Income and Expenses

Small businesses often grapple with the challenge of tracking their income and expenses accurately. However, the best accounting services ensure that they execute this crucial aspect of financial management meticulously. Therefore, by maintaining a detailed record of income and expenses, small businesses can gain better control over their cash flow, identify areas of cost savings, and make necessary adjustments to optimize their financial efficiency.

Budget Management

Effective budget management is another integral component of financial success. Therefore, accounting services assist small businesses in creating and maintaining budgets that are realistic yet ambitious. Hence, these budgets are roadmaps for financial planning and decision-making, helping small companies allocate resources efficiently and prioritize their financial goals.

Financial Data Analysis

Analyzing financial data is a complex but essential task. At this time, accounting services for small businesses have the tools and expertise to perform this analysis effectively. Undeniably, they review financial statements, assess key performance indicators, and provide insights that guide strategic financial decisions, such as expansion plans, investment opportunities, or cost-cutting measures.

Maximizing Efficiency

Definitely, efficiency is the cornerstone of a thriving business. Undeniably, accounting services aim to maximize financial efficiency by streamlining processes and identifying opportunities for improvement. Naturally, by eliminating redundancies and optimizing resource allocation, small businesses can operate more cost-effectively and realize greater profits.

Real Estate Accounting Services

Real estate businesses are a distinct breed with intricate financial demands. They require a specialized approach, which is precisely where real estate accounting services come into play. These services can cater to the unique financial requirements of real estate operations. By specializing in property management accounting, lease accounting, and tax compliance for real estate transactions, they offer invaluable expertise.

By availing the services of real estate accounting specialists, you can guarantee that your real estate business operates seamlessly and efficiently, navigating the intricate financial landscape of the real estate industry.

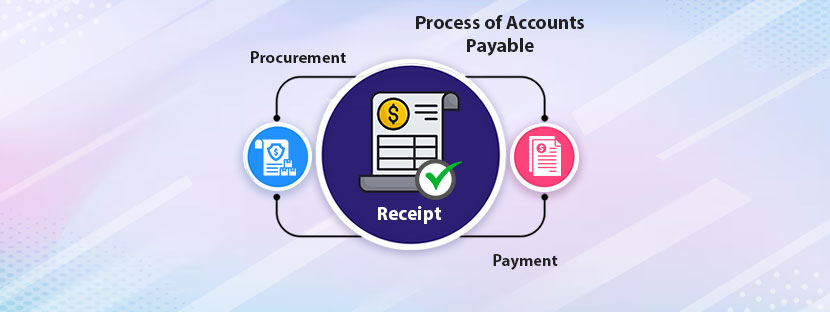

Leveraging Automated Accounting Services

In the modern business world, automation is the linchpin of operational efficiency. Automated accounting services harness cutting-edge software to streamline routine financial tasks. By automating functions such as data entry, invoice generation, and reconciliation, these services offer various benefits that directly contribute to enhanced economic efficiency.

Incorporating automated accounting services into your small business operations is a strategic move that yields tremendous benefits. It preserves time, lowers the risk of errors, and ultimately elevates your financial efficiency, permitting you to concentrate on core company activities and strategic decision-making.

Customized Accounting Services Packages

One of the critical lessons in small business management is that a one-size-fits-all approach rarely yields the desired results, especially regarding accounting services. Customized accounting services packages aim to cater to the specific financial needs of your business. This level of customization ensures that you pay only for the services directly relevant to your operations. By optimizing your financial resources, you can effectively manage your budget and allocate funds where they matter most.

Embracing Cloud Accounting Services

The origin of cloud technology has revolutionized the method businesses manage their finances. This type of accounting services for small businesses offers a range of benefits that enhance financial efficiency and decision-making. They provide real-time access to your financial data from anywhere, enabling you to make informed decisions on the go. This accessibility and flexibility are crucial in today’s fast-paced business world, where timely decisions can differentiate between success and stagnation.

Tax Accountant for Small Business

Taxes are often considered a daunting aspect of financial management for small businesses. However, including a tax accountant for small business can alleviate this burden. These experts specialize in tax planning, compliance, and optimization. By enlisting their services, you can maximize tax benefits, reduce tax liabilities, and ensure that your tax-related activities align with regulations. It, in turn, significantly boosts your financial efficiency.

Best Virtual Bookkeeping Services

Virtual bookkeeping services offer the convenience of outsourcing your bookkeeping needs to experts who work remotely. These professionals handle data entry, reconciliations, and financial reporting. By leveraging the best virtual bookkeeping services, you can concentrate on core business actions, knowing that your financial records are maintained accurately.

The Role of Accounting and Bookkeeping Firms

Accounting and bookkeeping firms dedicate themselves to providing a full suite of financial benefits. They have the expertise and help to handle everything from day-to-day bookkeeping to complex financial analysis. Partnering with such firms can significantly improve financial efficiency by outsourcing vital economic functions.

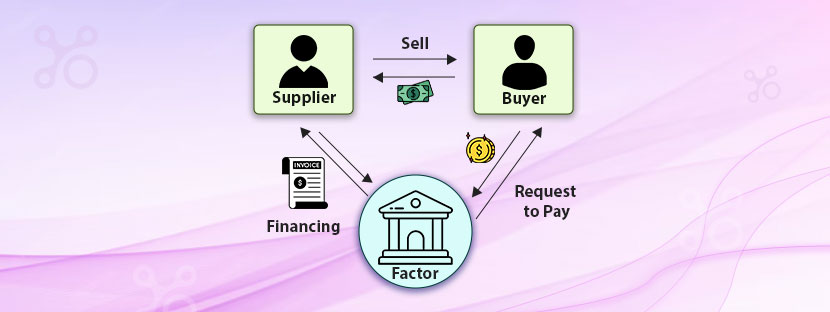

Minimize the cost of accountant for small business

Be ready with the accounting data. That’s the only way to save small business accountant costs. Nowadays, software is there to perform all accounting tasks. Your tasks are almost done when you prepare your accounting data through bookkeeping data entry services. The need for an accountant for a full-time role can be minimized. Of course, you can hire an accountant at the end of the year to cross-check the balance.

The Connection with Outsourcing Bookkeeping Data Entry Services

Outsourcing bookkeeping data entry services can be closely linked to the efficiency of your financial management. When you outsource these services, you tap into the expertise of professionals in data entry and control. It allows your in-house group to focus on strategic financial planning and decision-making, enhancing overall economic efficiency.

Accounting services for small businesses and bookkeeping data entry services are indispensable tools for enhancing financial efficiency. By offering tailored solutions and expert guidance, companies can keep proper economic records and make informed decisions, ultimately leading to financial success.