Data is valuable only if it’s refined. From banking to credit management operations, the importance of refined financial data is immense. The process of financial data enrichment can help to refine transactional data and other factors of financial data to a large extent. Let’s discuss it in this blog with some real-life examples.

Let’s begin!

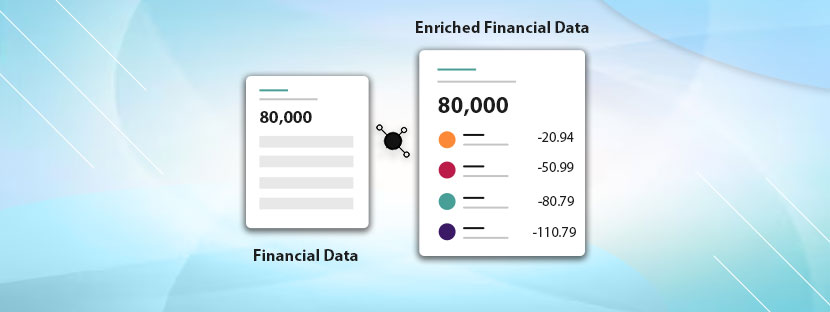

About Financial Data Enrichment

Like data enrichment, financial data enrichment focuses especially on enhancing financial information. Accuracy of the financial data is the supreme factor, and through financial data enrichment, the accuracy level is maintained.

Enriching financial data becomes crucial when it comes to analyzing financial data to make better decisions. Apart from that, it also helps to enhance the user experience of financial software and tools. Many fintech companies nowadays rely on outsourcing data enrichment services to get the financial data enriched. It’s the best way to stay compliant with local and international laws while utilizing the best financial information.

Type of Financial Data You Can Enrich

Each day, a gigantic volume of financial data is generated from different sources. Enriching financial data is technically different from collecting financial data. Enrichment serves more purposes. Anyway, you can enrich any type of financial data if you want. Here are the possible types of financial data that are popularly enriched;

Well, the list is quite wide. Using the best enrichment techniques is essential to make sure you utilize each element of your financial information perfectly. The following list of industries require the most financial data enrichment support;

If you fall under the above list of industries, you should get proper support for financial data enrichment from a professional company. Let’s understand the need for data enrichment for finance through an example.

Suppose a business owner who runs a coffee shop deposits daily whatever he made that day to his bank account. Some days, he deposits $6, and some days he deposits $30, whatever he deposits based on his that’s days effort. Think from a bank’s perspective now. One day, the man went to the bank and asked for a business loan.

Now, if the bank started enriching this person’s data from the first day, then it would know that this person needs a loan for entrepreneurship ventures. Instead of suggesting a generic loan, the bank can suggest better loans like entrepreneurship packages to this person. And that’s how it works.

Core Areas of Financial Data Enrichment

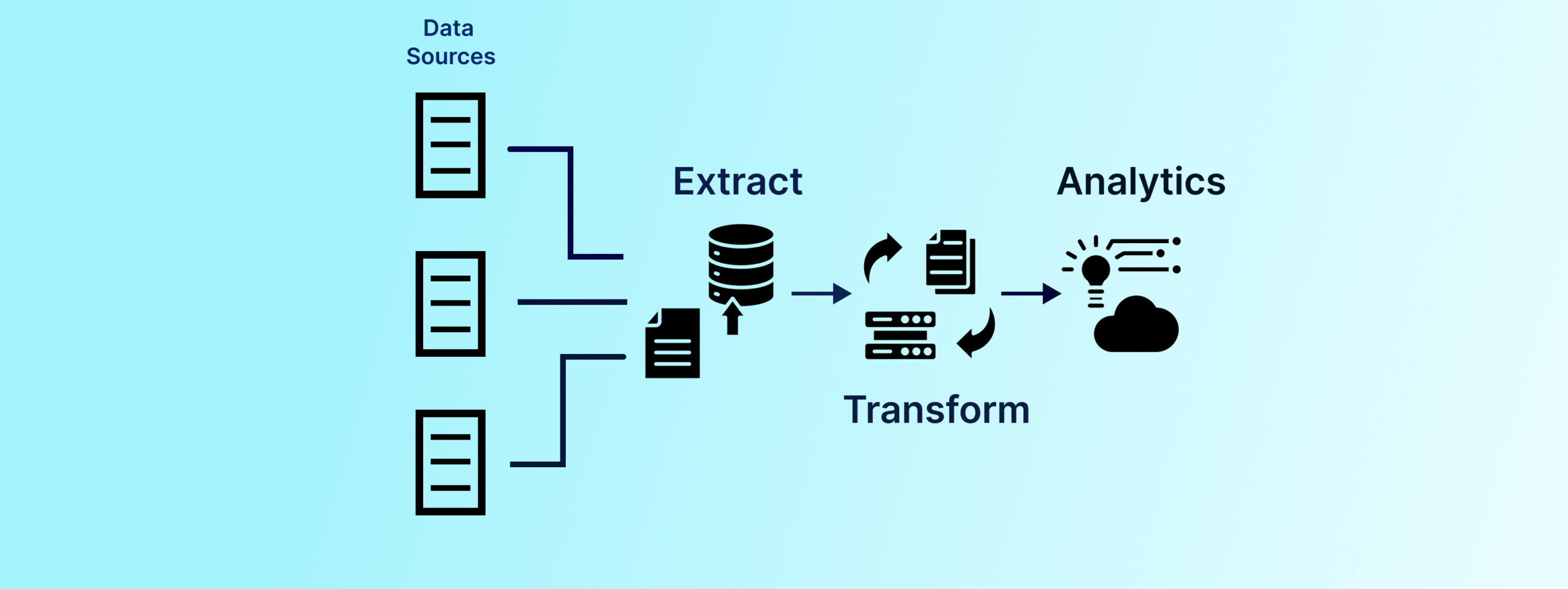

Data enrichment operations in financial matters come with a complete package. It includes data collection, data structuring, data assessment, data cleansing, and many other things. Let this section walk you through all the core areas of data enrichment made for finance.

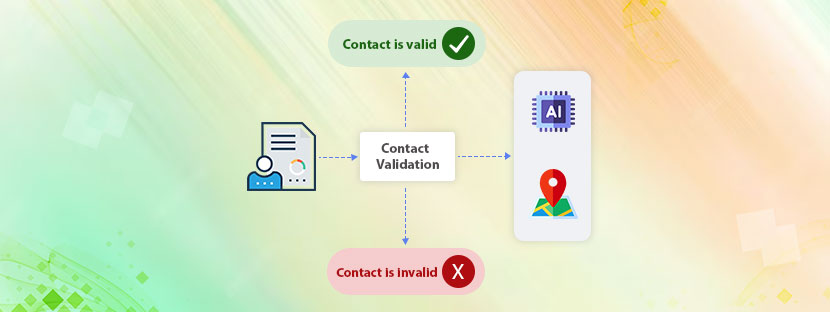

Fix and clean transaction data

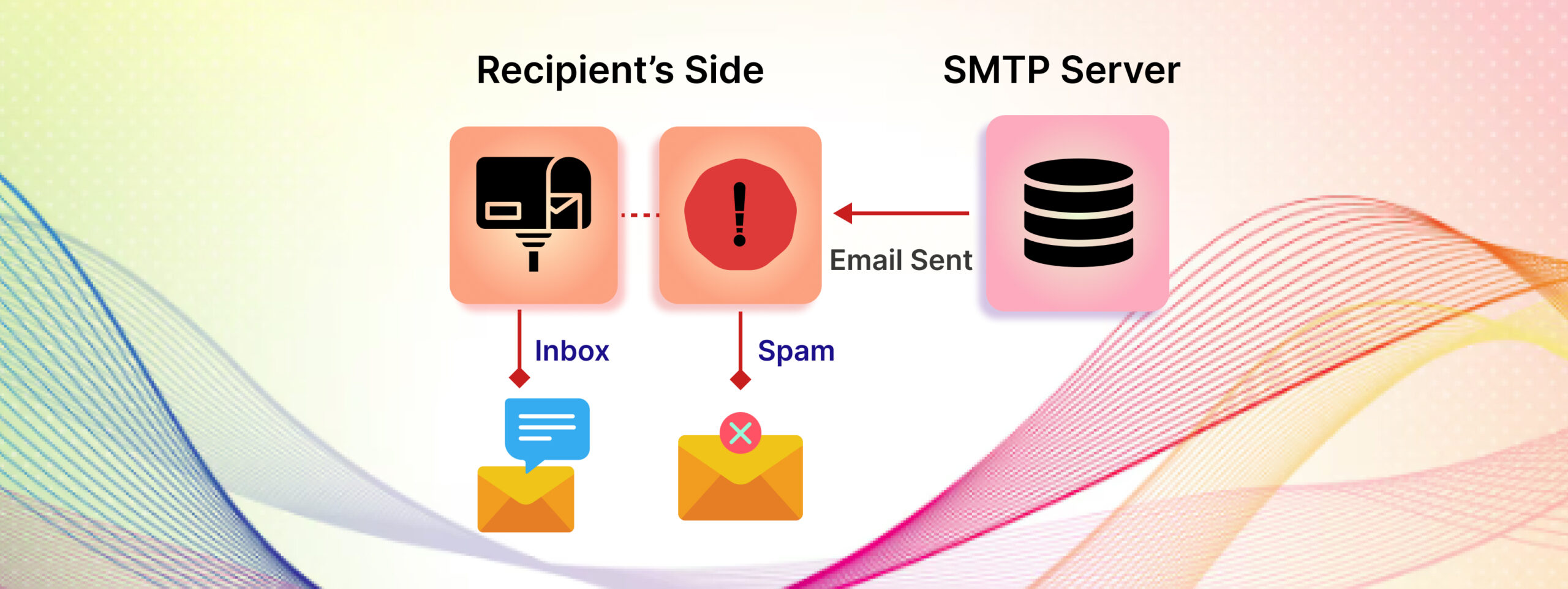

Transactional data usually gets stored in the payment database in raw format. Nothing special is done on its behalf to manage them properly. Enriching transactional data is super important because it helps in data analytics and further, it helps make strategic decisions. Therefore, the first thing you need to fix is cleaning the raw transactional data and making the database organized.

For example, you might have data in your transactional database that looks like “BGD*PastryHouse Bill 20.12 paid, bal 3521.32” or something. With a little indication, it can be understood that this transaction has a few elements. First, the reference here is BGD. Basically, it’s a bill that has been paid. The shop’s name is Pastry House, where $20.12 is paid as a bil,l and the remaining balance is $3521.32.

With the input from financial data enrichment, data in raw format can be arranged and placed in proper order. It would remove noise from that data and make it special and easy for everyone to understand.

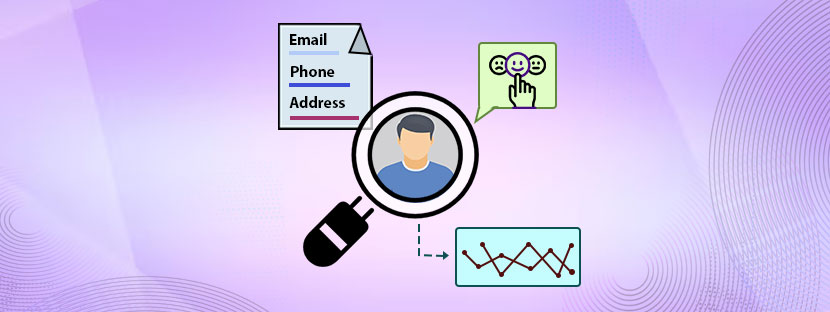

Categorize transaction data

Categories make datasets organized and properly placed. Every big database has been managed through proper categories. It helps them to find the database easily and on time without wasting time in searches. Once the data gets cleaned, tactics of financial data enrichment help categorize the data.

Taking reference from the previous example, you can put the amount you paid to Pastry House into the expenses category. Further, you can categorize Pasty House as a “restaurant” to refine the expense amount.

This looks simple, but it can consume a lot of time. However, once you do, it can untangle every single penny you spend categorically. It helps better planning and making strategic financial decisions.

Sector-Wise Financial Data Enrichment

Banking Operations

For banks, data enrichment simply means adding more security layers to the existing data plus looking for long-term profitability. Enriching financial data can add great value to banks as it makes the banking operations productive. With this, banks can target specific customers and offer them loans accordingly. Banks can understand their customers better and develop their products based on that. Ultimately, it will serve banks’ purposes and help people in general.

Credit Risk Management

Credit scoring is based on a solid algorithm that includes various critical measures and calculations. This algorithm works better when it gets all data properly arranged. Financial data enrichment helps improve credit scoring algorithms. It improves the efficiency of risk assessment. With the help of enriched data, the creation of a detailed risk borrower profile is possible. Prediction of risk and defaults is also easy when you have all the data enriched with the latest insights.

Investment Market

Customers always trust their investment agencies for their sustainable money growth. With the help of financial data enrichment and intensive financial market operations, investment agencies rebuild investment strategies for their customers. They recommend high-potential investments to get the maximum returns. With the enriched datasets, they can also predict fresh new investment possibilities.

Besides this, financial data enrichment is a critical element in other industries, too. It includes loan disbursal, insurance, marketing, stock, and other high-income-yielding industries.