Running a small business feels like juggling balls. You have to wear too many hats. Right?

Sometimes you have to be your own financial advisor and sometimes do your own bookkeeping. But anyway, have you thought about how you would manage your expenses when your customers pay late?

Suppose you assumed that your customers would pay the invoice on time. But they didn’t. Now, with limited funds, how would you cover your regular business expenses?

Here comes the concept of invoice factor, where some factoring companies can help you. They can pay you (in the form of loans) against your invoices. You can get the money and meet regular business expenses even if your customers don’t pay the invoice on time.

Got it, right?

If not, then don’t worry! We will cover everything regarding invoice factoring, including how it works, in this blog. Let’s get it started.

What is the Invoice Factor?

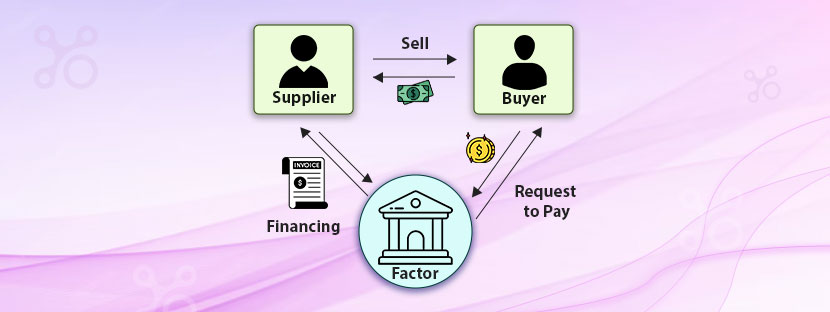

Factoring firms are a financial institution that helps small businesses manage their immediate cash needs. These firms pay advance money (partial) against your invoice amount once you issue. On your behalf, they will collect the invoice amount from your customers and will pay you the money. Note that they will charge a small portion of the payment as their fee.

Let’s understand the matter through two common instances;

⏵ Instance 1: When You Collect Invoice Amounts on Your Own

Suppose there is a small business owner named Robin who decides to manage his invoices on his own. He maintained an Excel sheet for these customers whenever he issued invoices. He usually issued invoices to his loyal customers for 30 days. It means he expected his customers would pay him the invoice amount within 30 days.

Unfortunately, he had a limited fund and was completely dependent on his customers to run the business operations. It was good until the one customer with a due amount of $10,000 did not pay on time. It went on, and the customers did not release the amount for 2 weeks. Meanwhile, Robin could not manage to regularize his cash flow operations as the money was stuck. Because of this, he also lost many deals. Ultimately, it badly affected his small business.

That’s just the basic data enrichment practices that can go far beyond. They can provide you with more intensive information regarding your prospects. Thus, you can shape up your personalized marketing game based on that information. Let’s detail everything in the coming sections.

⏵ Instance 2: When Invoice Factoring Company Collects Your Invoice Amount

Let’s take Robin’s case again and explain how the invoice factor could help him if he tried it before. Now, with the same rules of waiting 30 days to realize the invoice, Robin agreed with an invoice factoring company. But here the catch is he can now take the invoice amount in advance (nearly 80% to 9% advance is allowed).

So, when Robin issued an invoice of $10,000 to a customer, the factoring company would collect that in order to provide Robin with the advance money. The factoring company will collect the invoice amount due from the customers and provide Robin with the balance.

In this case, the factoring company, let’s say, charges 4% of the invoice amount. Therefore, the company will pay Robin $9600 as the company would charge $400 as a fee. Again, if Robin applies for advance payment, he is eligible to get $8000 (if 80% in advance is allowed). Thus, the amount he would get at the final settlement is $1600 (he would get $9600, but he has taken $8000 already, so he would get only the remaining balance).

However, the great thing is that Robin didn’t have to wait for his customers to pay on time. He can manage his business expenses without any dependency.

Is your small business eligible for invoice factor?

Like a loan-providing company, invoice factoring companies check multiple things about our business before sanctioning any sort of guarantee. Invoice factoring works great for B2B companies that offer 30 to 90 days of payment terms. However, the eligibility for invoice factors varies from firm to firm. If we sum up the commonly practiced business procedures, then we can get the following things to determine the eligibility criteria;

How does the invoice factor work?

As you have understood from the above discussion, factoring companies secure invoice payments against a nominal fee. Let’s get it explained further to understand it in more detail on how it works.

First, you need to find an invoice factoring company to sell your outstanding invoices. Before choosing anyone, you need to read all the policies and check the service fees. That’s the most crucial part of the entire process. The market of invoice factor is quite large and it will hit $5348.6 billion by 2029. These companies have rapidly grown over the years and helping small businesses comprehensively.

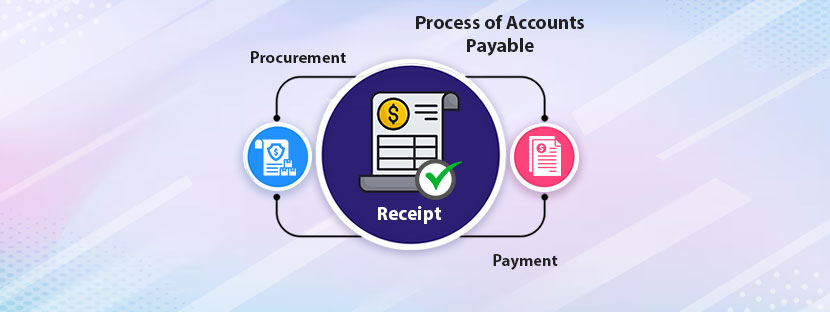

After you sell your outstanding invoices to the factoring company, you need to wait for processing. Usually, it can take 1-4 business days. After processing, you can get 75% to 90% of the invoice amount as an advance. The factoring company will send a notice to your customers once you get the advance payments. One thing you need to keep in mind is that the advance payment depends on the size of your transaction, risk factors, and other things.

Now, coming back to fees, the factoring companies may charge 1% to 4% of the invoice amount as their fees. They only charge the fees when they realize the amount from your customers.

Pros of invoice factoring for small businesses

Small businesses can get the most extraordinary advantages of the invoice factor. They would never face a liquidity crunch once they sell their outstanding invoices to factoring companies. Plus, it does not require any collateral to get the advance amount. This is even cheaper than all bank loans. Apart from the benefits of small businesses, there are many benefits you can explore, such as;

Some considerations of invoice factoring

Everything comes with a cost. There’s no such exception when you choose the invoice factor. However, it’s always better to process your invoice professionally before you explore invoice factoring. This will help you get the advance amount faster and meet all the regularity matters.