Do you run an insurance business and currently looking for insurance claims data entry services? If yes then congratulations, you have proper knowledge about the outsourcing process. Well, if you still need to be convinced then this blog is just right for you.

Here we’ll discuss outsourcing insurance data entry tasks in detail. You will explore how outsourcing service providers record insurance claims through excellent data entry services. Also, you will find the best and most logical reasons here in favor of outsourcing insurance data entry services.

So keep reading to find your reasons!

Anyway, do you know that outsourcing is a smart choice? Of course, it is the smartest option, especially for data entry services. Insurance companies have to deal with enormous volumes of data every day to disburse claims. Therefore, they hire skilled employees to process the data entry tasks. But do you realize that data entry is not a core function of an insurance company?

Therefore, by opting for insurance claims data entry outsourcing, insurance companies can efficiently manage large volumes of data. Besides that, you can focus more on the core functions rather than keeping engaged with data entry-related work to organize your data. Moreover, outsourcing is far better and more economical than hiring a team of in-house data entry workers.

After discussing the basics, now it’s time to discuss how an outsourcing company can help your insurance business.

A. What Do Insurance Claims Data Entry Outsourcers Do?

Outsourcing tasks are more like some external help that businesses opt for to manage the extra burden of work. This thing you can find similar when you opt for insurance data entry services. But not limited to this, by choosing outsourcing, you can explore a lot of more options too.

Outsourcing service providers will accurately document all your data in the correct format to assure quality standards. In insurance data, accuracy plays the most important role as companies disburse claims based on that. Besides that, the insurance sector is passing through a sharp change in the operating procedure. Thus, insurance companies need strong data support to teach the change.

Outsourcing companies streamline data entry-related tasks on behalf of the client company by maintaining quality standards. With the help of robust data entry outsourcing services, insurance companies can make competitive business plans.

Moreover, getting the insurance claims data entry services via outsourcing can reduce the cost factors also. Outsourcing is cheaper than recruiting a team of in-house data entry experts specialized in insurance data entry. The outsourcers can handle the following data entry tasks in the insurance domain.

B. Reasons to Outsource Insurance Claims Data Entry

1. Save Costs

Outsourcing your insurance data entry can be a big money-saver. When you team up with a specialized outsourcing company, you avoid the costly process of hiring and training in-house employees. This saves money on recruitment, salaries, benefits, office space, equipment, and software.

Moreover, outsourcing lets you tap into the skills of professionals who excel at handling insurance data entry with speed and precision. Their expertise means quicker processing times and fewer mistakes, reducing the need for rework or corrections and ultimately saving you more money.

Additionally, outsourcing your data entry task offers flexibility in scaling your operations as required. This ensures that you only pay for the specific services you need, making it a cost-effective solution.

Thus, outsourcing your insurance data entry not only cuts down on hiring and training expenses but also brings in skilled professionals, leading to faster and more accurate processes. This, in turn, minimizes the costs associated with errors and provides the flexibility to adjust your operations based on your needs, ultimately saving you money in various aspects of your business.

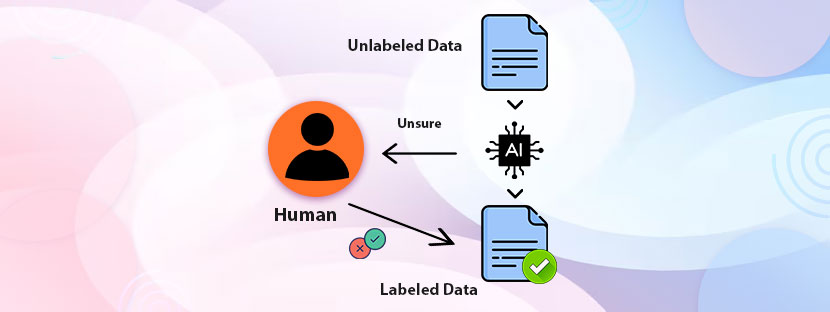

2. More Accuracy

When you decide to outsource your insurance data entry, you’re in for a big boost in the accuracy of how your claims are handled. When you hand over this job to a special team, you get the advantage of their skills and super careful attention to detail. These pros know the ins and outs of insurance claims data entry, making sure that every bit of info is put in with care and consistency. They stick to really strict quality checks, looking over entries carefully to keep any possible mistakes to a minimum.

Moreover, outsourcing opens the door to using fancy technologies like optical character recognition (OCR) and intelligent data capture systems. These tech tools take the accuracy of the process up a notch. With better accuracy, you can sidestep pricey errors, lower the chances of claims getting rejected, and ultimately offer better service to the folks covered by your policies. Also, they will opt for enhanced data security measures along with this.

This newfound precision lays the groundwork for a more efficient way of handling your claims processing, as we’ll delve into in the next part. So, by outsourcing, you can streamline data entry-related tasks, you’re not just getting accuracy; you’re setting the stage for smoother and more effective management of your large volumes of data. It’s like having a trusty team that’s all about getting things right and using cool tech to make everything run even better.

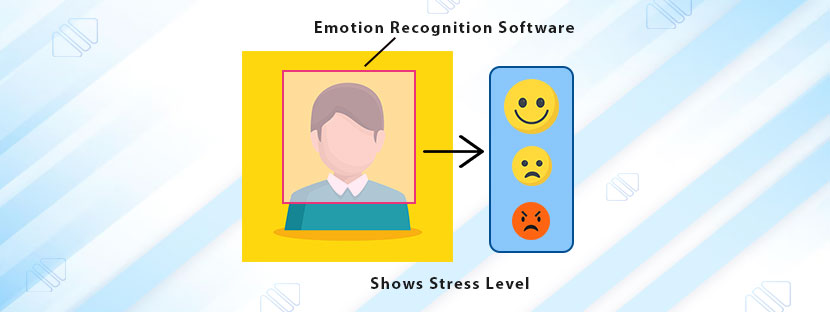

3. Strong Data Security

When you decide to get help from an outside partner for your insurance claims data entry, you’re not just getting support – you’re also getting a boost in keeping your business data super safe.

Data safety is a big deal for insurance companies because they deal with really private info. By teaming up with an outsourcing buddy, you get to tap into their top-notch and enhanced data security measures. This includes using fancy encryption protocols, making sure data is transmitted super securely, and having strong firewalls in place to keep out anyone who shouldn’t be poking around.

Moreover, these outsourcing pals usually have strict rules about keeping things hush-hush. They make their employees sign agreements promising not to spill the beans and even run background checks to ensure everyone’s on the up and up. They also do regular checks to sniff out any weak spots in their security and fix them up.

So, by outsourcing your data entry, you’re not just getting help with the workload – you’re also getting a serious upgrade in keeping your important business data locked down tight. It’s like having a security squad on your side, making sure everything stays safe and sound.

4. Flexible Options

Besides an enhanced data security measure, outsourcing comes up with flexible pricing and other options, which can scale up your business operation rapidly. By opting for insurance claims data entry services, you can manage to handle all your insurance claims and organize your data in time.

During peak periods, insurance companies have to deal with a lot of claims within a few hours. Hence, managing all claims efficiently within a quick span is an overwhelming experience for an in-house team. With outsourcing, companies can flexibly process data with all measures by eliminating the factors of delays.

On the contrary, when there is a lean period then the company can pause the contract with the outsourcer. Therefore, companies can use the outsourcing team based on their requirements and it will save their costs. Moreover, outsourcing does not involve any kind of training cost, unlike the in-house recruitment process.

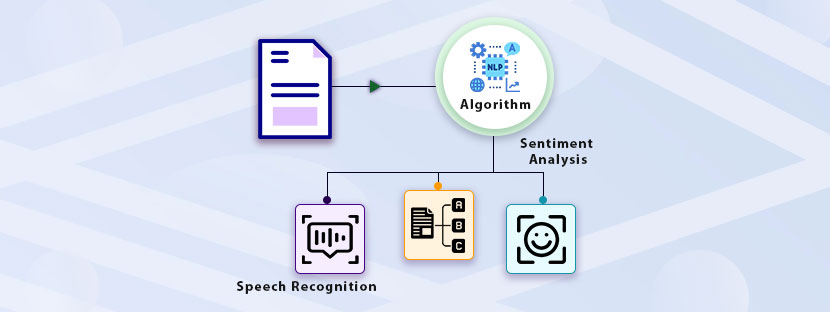

The work of insurance data entry is complex and it demands skilled professionals. It needs an intelligent data capture method to get quality insurance data. Besides skills, the application of the latest software in claim disbursal also helps in minimizing the cost factors. With the help of outsourcing, companies are getting the chance to utilize software for assessing insurance claims. Also, it helps to adapt to the industry changes accurately but a lot faster.

5. Make the Process Efficient

Outsourcing insurance claims data entry services can make the system efficient and better. An outsourcing company can assess an enormous volume of data faster with no errors. The insurance sector is highly volatile and it accommodates rapid changes. Therefore, companies working in this sector need to have a system that delivers data faster.

Thus, outsourcing comes out as a solution to fix the issues related to faster delivery. Outsourcing service providers streamline the insurance claim process with their excellent data management procedure. Besides workflow, they can complete the process within the set deadline.

Besides that, outsourcing is a way to relieve the burden on your in-house members regarding data entry work. They do not need to stay focused on the task to streamline data entry work rather they can focus on other valuable work. This not only increases the productivity of the operation but also makes the system more efficient. Also, as you delegate the work to outsourcers thus you can expect the process to be free from all errors.

Insurance companies deal with a lot of things while distributing proper claims to the insurance claim holders. Thus, these companies often need quality data to initiate the claim disbursal process. So, outsourcing service providers ensure that these companies are getting quality insurance claims data entry services on time.

6. Get the Expertise

Imagine you have to hire an executive for the insurance data entry role and you got two options. First, you can choose a fresher who has recently graduated from a college. Or, you can hire a person who previously served in an organization with a similar role and dealt with large volumes of data. Obviously, you would choose the second option because that is more relevant in this regard.

By taking that reference, an outsourcing company has more skills than others in dealing with insurance claims. They can efficiently bring their expertise into the insurance data entry process. Also, they have intense knowledge of working with insurance companies and they understand all regulations as well. Therefore, they can implant their best method while serving as data entry professionals in your operations.

Can you expect timely delivery of files from an expert data entry professional? Of course, yes! An expert data entry executive can deliver work within a fixed time by maintaining proper quality. Besides that, expert insurance claims data entry professionals are familiar with all insurance terminology, rules, and regulations. Moreover, they understand the application of advanced tools in claim data assessment well.

Hence, with the help of expert professionals, you can have an improved and efficient system in your organization. Because you will have an intelligent data capture method deployed in your system. Further, the expert professionals will also increase the accuracy level of the data assessment. They will increase the value of your insurance business by adding value through processed data. So that you can focus more on your core operation besides your tasks to organize your data.

7. Involve in Core Functions

The main advantage of outsourcing insurance data entry is to stay focused on the core functions. In simple words, businesses can focus on the core functions with the help of outsourcing. Do you want to know how? Well, the tasks of insurance data entry is not a simple job as businesses have to stay dedicated here.

However, when an outsourcing company takes over all the insurance claims data entry work then businesses will have more time. They can give time to their core business functions and make informed decisions for the process. Focusing on core functions also indicates more efficiency in the insurance business.

Also, insurance companies can efficiently compete with all close competitors with the help of outsourcing. With a properly assessed database, companies can disburse claims more efficiently and quickly.

8. Get Service on Time

Companies that are serving the outgoing data entry services are working 24/7 all around the clock. Therefore, you can expect your service to be delivered on time without even a time barrier. Most of the outsourcing companies operate in the Asian region but they are very strict in maintaining time zones.

Insurance companies need the claim data on time to initiate the further procedure. Therefore, outsourcing insurance claims data entry services can help them to get all data accurately on time. Thus, they can initiate the claim disbursal process and relieve data entry stress. With a clean dataset, companies also can disburse claims faster, which will also satisfy their customers.

Lastly, outsourcing is a good option and here 8 reasons have been explained to defend that. Outsourcing agencies are working with highly skilled people to handle insurance data entry tasks. Thus, they can help you in serving what you need but with excellence.