In This Article

How can small businesses always ensure their financial management is cost-effective and efficient? In addition, what tools are available to access expert financial expertise without exceeding their budget? Moreover, these questions loom large in the minds of small business proprietors, who often wear multiple hats and must find innovative ways to navigate their financial operations. Now, in exploring the benefits of online bookkeeping services, we will delve into online financial management solutions and uncover the advantages they offer to small businesses.

Small business owners always face a challenging juggling act, managing their finances while driving their businesses forward. Furthermore, how can they access the best bookkeeping services, harness the expertise of the best online accountants, and then ensure their financial records are meticulously maintained, all without the need for in-house financial staff? However, the world of bookkeeping services provides an answer to these questions.

The benefits of online bookkeeping services definitely extend beyond just cost savings. Unquestionably, small businesses can streamline their financial processes, seamlessly integrate payroll and bookkeeping services, access expertise regardless of their physical location, and simultaneously receive personalized services tailored to their specific needs. Therefore, whether it’s restaurant bookkeeping services or comprehensive tax preparation, this type of bookkeeping service offers a robust suite of financial tools. Now, in this blog, we will discuss how these benefits donate to the development and victory of small businesses. So, at this time, let’s dive in and discover the advantages that bookkeeping services can bring to small businesses in today’s fast-paced business landscape.

Cost Savings with Best Online Bookkeeping

In the realm of small business financial management, cost-effective solutions are of extremely paramount importance. Surprisingly, small businesses often operate within tight budgets, necessitating the need for innovative financial strategies. Since, bookkeeping services have emerged as a game-changer for small businesses, primarily due to the significant cost savings they offer. Now, this section will explore how the best online personal bookkeeping services contribute to cost efficiency, allowing small businesses to access professional accounting expertise while maintaining a lean financial structure.

Streamlined Financial Management

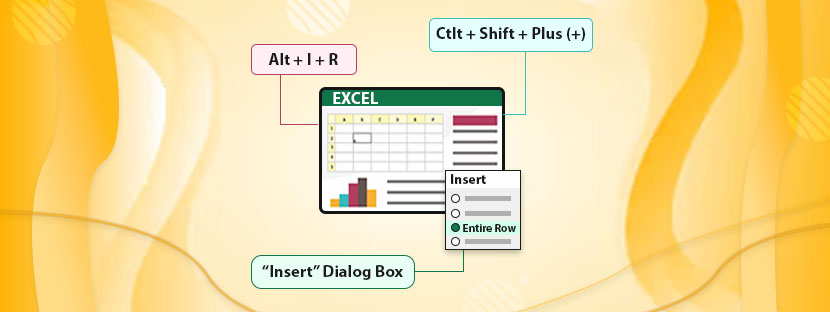

However, one of the most critical cost-saving benefits of online bookkeeping services is the streamlining of financial management processes. In fact, small businesses can transition from traditional, paper-based record-keeping to an automated and digital system, reducing the need for physical storage space and minimizing printing and lastly administrative costs. Moreover, best online bookkeeping allows for secure digital storage of financial records, eliminating the expenses associated with paper, ink, and physical storage facilities.

Reduction in Payroll Expenses

Employing in-house accounting staff comes with many expenses, including salaries, benefits, and then overhead costs. Meanwhile, online personal bookkeeping services eliminate the need for a dedicated in-house accounting team, reducing labor expenses. After all, small businesses can access professional accounting expertise on a need-to-use basis, ensuring that they only pay for the services they require.

Minimized Errors and Compliance Costs with Online Bookkeeping Services

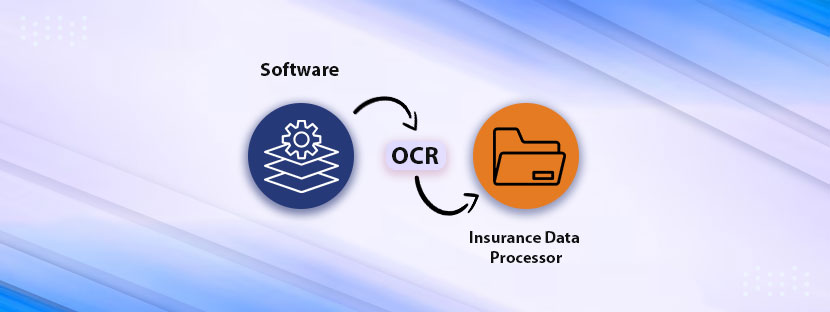

However, Online bookkeeping services utilize advanced software and technologies to maintain financial records with a high degree of accuracy. Although, this accuracy significantly reduces the chances of errors in financial reporting. Besides, small businesses can avoid costly mistakes, such as inaccuracies in tax filings or payroll, which can lead to fines and penalties. In addition, by staying compliant with financial regulations, small businesses can save substantial compliance-related costs.

Enhanced Efficiency and Resource Allocation

Small businesses sometimes operate with limited resources, and efficient allocation is essential for growth. Nevertheless, by leveraging the cost-effective advantages of bookkeeping services, small businesses can allocate their financial and human resources more effectively. In addition, the financial savings can be channeled into marketing, product development, or expanding operations, surprisingly driving the business’s overall growth.

Access to Professional Expertise without Overhead

The best bookkeeping services definitely provide small businesses with access to professional accounting expertise without the burdensome overhead costs associated with in-house staff. Undeniably, these services employ experienced and qualified accountants who can offer guidance on financial management, tax strategies, and compliance. Following this, small businesses benefit from this expertise without incurring the costs of hiring, training, and retaining in-house accounting professionals.

Expertise at Your Fingertips with Best Online Accountants

Unquestionably, small businesses often grapple with complex financial management tasks. Evidently, they must navigate intricate accounting principles, stay compliant with ever-evolving tax regulations, and implement sound financial best practices to ensure financial health. Simultaneously, the emergence of the best online accountants offers small businesses a lifeline, providing them with an invaluable source of expertise. Concurrently, this section explores how the best online accounting services bring a wealth of knowledge and skills to assist small businesses in maintaining accurate financial records, preparing financial reports, and lastly, ensuring tax compliance.

A Wealth of Accounting Knowledge

The best online accountants are not just financial professionals; they are specialists in their field. They maintain a comprehensive understanding of accounting principles, including IFRS (International Financial Reporting Standards) and GAAP (Generally Accepted Accounting Principles). This depth of expertise allows small businesses to maintain their financial records accurately, reflecting transactions and financial statements in a manner that adheres to recognized accounting standards.

Mastery of Tax Regulations

Tax compliance is a critical aspect of financial management, and the best online accountants excel in this area. You can get them with the best online accounting services. They stay updated with ever-changing tax regulations at the federal, state, and local levels. By accessing their services, small businesses can ensure they are compliant with tax laws, minimize their tax liabilities, and avoid penalties or legal issues that may arise from non-compliance.

Financial Best Practices

Online accountants do not just record financial data; they also recommend and implement financial best practices that can contribute to the long-term financial health of small businesses. They offer guidance on financial planning, budgeting, cash flow management, and investment strategies. By integrating these best practices, small businesses can optimize their financial operations and work towards achieving their financial goals.

Streamlined Online Accounting with Online Bookkeeping Services

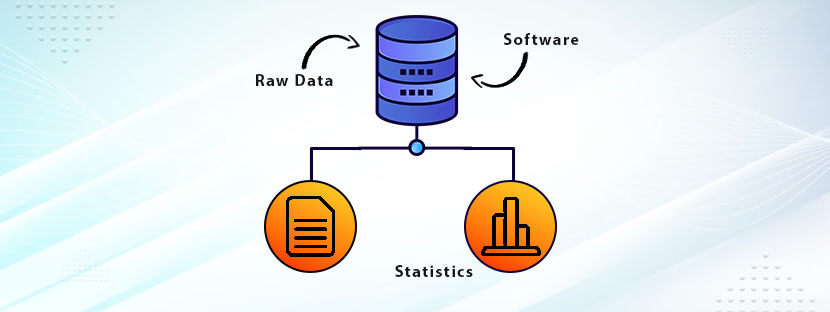

Online accounting is a dynamic and efficient approach to financial management that can revolutionize how small businesses handle their finances. The process of online accounting is characterized by its convenience, accessibility, and real-time capabilities, making it an attractive choice for small businesses looking to streamline their financial operations.

Digital Document Management

Small businesses can upload their financial documents securely to the online platform, providing a safe and organized repository for all financial records. This digital document management eliminates the need for physical paperwork, reducing the clutter and physical storage requirements associated with traditional accounting methods.

Remote Access and Management

Online accountants can access and manage financial data remotely. Small businesses can grant access to these professionals. They enable them to update financial records, reconcile accounts, and prepare reports without face-to-face meetings. This remote access facilitates efficient and real-time financial management. It allows small business owners to monitor their financial health from virtually anywhere, at any time.

Seamless Payroll and Bookkeeping Services

Payroll and bookkeeping are core functions of financial management for small businesses. Accurate payroll management ensures that employees are compensated fairly and in compliance with tax regulations. Simultaneously, bookkeeping maintains detailed financial records vital for compliance, decision-making, and business growth. Integrating payroll and bookkeeping services offers a seamless approach to these crucial functions. It reduces the likelihood of errors and enhances efficiency.

Accurate Payroll Management

Online bookkeeping services integrate payroll management, accurately calculating employee compensation, deductions, and tax withholdings. This integrated approach ensures that small businesses comply with tax regulations and labor laws. Thus, it reduces the likelihood of payroll-related errors resulting in legal complications and financial losses.

Detailed Financial Records

Small businesses benefit from maintaining detailed financial records through bookkeeping. These records provide insights into their financial health, helping them make informed decisions. Integrating payroll data into these records ensures that all financial aspects are synchronized, creating a holistic financial overview. This streamlined approach minimizes the risk of errors, improves efficiency, and saves valuable time for small business owners.

Accessibility to Expertise – Bookkeeping and Tax Services Near Me

Online bookkeeping services provide small businesses with access to expertise that may not be readily available locally. These services transcend geographical boundaries, allowing small businesses to collaborate with experienced professionals. However, they may need a physical presence in their vicinity. Small businesses can benefit from the best bookkeeping and tax services, regardless of their physical location, by searching for bookkeeping and tax services near me.

Tailored Services – Restaurant Bookkeeping Services

Each industry has unique financial requirements, and small businesses often require industry-specific solutions. Online bookkeeping services offer tailored packages, such as restaurant bookkeeping services, designed to meet the specific needs of companies in the food service industry. These specialized services ensure that small businesses receive the level of detail and expertise required for their niche.

Simplified Tax Preparation and Bookkeeping

Taxes can be a complex and time-consuming aspect of financial management for small businesses. These bookkeeping services simplify tax preparation and bookkeeping by maintaining organized financial records and tracking income, expenses, and deductions. At this time, this preparation helps small businesses to comply with tax regulations. Thus, it minimizes the risk of audits and takes advantage of tax-saving opportunities.

Personalized Bookkeeping Services

Small businesses often benefit from a personalized approach to bookkeeping. These bookkeeping services ensure that they meet the unique financial needs of each small business through a high level of customization. This personalization includes tailoring financial reports, designing charts of accounts, and providing insights specific to the business’s financial goals.

Online bookkeeping services have proven to be a game-changer for small businesses. It offers various advantages encompassing cost savings, expert guidance, streamlined processes, and integrated financial management. However, these services empower small businesses to access professional expertise while maintaining lean economic structures. Thus it allowing them to allocate their resources effectively.

With the convenience of real-time access and digital record-keeping, small business owners can monitor their financial health from anywhere. The seamless integration of payroll and bookkeeping further improves efficiency and decreases the risk of errors. Small businesses, regardless of their industry or location, can leverage the benefits of online bookkeeping services to ensure financial health and drive their success in today’s competitive business landscape.