Confusion between liability and expenses is real!

It happens most when it comes to dealing with salaries in accounting. A common question that comes to your mind like, “Is salaries expense a liability?”

If you’re a small business owner and looking for some help regarding salary accounting, this blog is for you. Here, we are going to explore how we can manage salaries in accounts and do the bookkeeping part. Let’s start with the concepts first!

Understanding Salary Expenses

Salary expenses present the total amount of salaries and wages paid to employees during an accounting period. In accounting terminology, salaries are operating expenses, which are deducted from revenue. After deducting operating expenses like salaries from the revenue, the net income of the company will be revealed.

Some key considerations for reporting salary expenses to the accounting system are;

▶ Posting

Like the other operating expenses, salary expenses are reported to the income statement. [An income statement contains all accounting information of the company’s revenue and income over a given period.]

▶ Matching

Following the accounting principle, salary expenses are matched with revenue in order to make the payment. Remember, salary expenses are paid against the revenue that is earned in the same period.

▶ Accrual Accounting

Salary and wages are recorded in the books of accounts when they are earned, not when they are paid. For example, if employees worked in march’s last week, they will get the payment in April. Still, the salary will be accounted for in the book against March’s salaries.

▶ Salaries Contain Various Things

Salaries are not like wages and other operating expenses. It contains various other things, which are treated separately. For example, payroll expenses like social security expenses, health insurance, commissions, etc., are treated differently, will not come in salary accounts.

What is Salaries Payable

Salary payable is an account that indicates how much a company owes its employees. It’s an account where the salary amount is stored, and later on gets distributed to the employees. Please note, salary payable is a liability, which is different from salary expenses.

Can you guess how many employees are working in the United States? Well, the data shows it’s about 163 million people are employed or closely associated with employment in the United States as of March 2025. Imagine accounts are handling the salary accounts of these employees to pay them.

Companies calculate the amount of salaries they need to pay the employees through the salary payable accounts. Balance of the salary payable increases when employees earn money, and the balance decreases when the employees get a paycheck. As it is a liability account so all the credit entries will increase its balance. On the other hand, debit entries will make the balance decrease. Salary payables are typically recorded at the end of an accounting period to reflect the company’s finances overall.

Why do you need to know about salaries payable?

You are searching for salary expenses, so why do you know about salaries payable? – A great question. To explain it, we need an example. Suppose you have 5 employees working with you, and each of them gets $2,000 per month. So, your salary expenses will be $10,000, but that will be paid via your salary payable account.

Organization leaders and accountants must be aware of the salary payable amount accurately so they can pay their employees on time. Accounts payable get the balance one year in advance, so the company knows how much it can spend on salaries for its employees. Plus, it also restricts companies from going beyond the budget for the operations. Many times, it’s been seen that companies are not able to pay employees their salaries by the end of an accounting period. That’s because these companies could store enough balance in their accounts payable account to pay salary expenses.

Here are some of the common reasons why companies must make accounts for salary payable;

- Payroll accounting and accounting in general are quite different. But the salary payable account creates a balance between the two.

- Accounting for salary payable is mandatory when a company has mostly salaried employees.

- Conflict related to salary payment can be easily resolved by accounting for salary payables.

- Proper management of salary payable can help the company with its budget allocation.

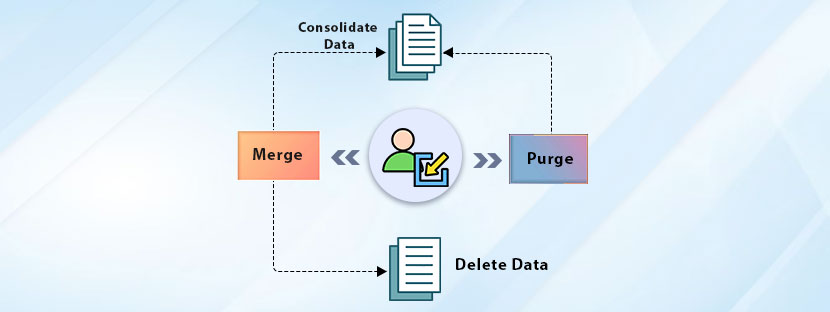

Salaries Payable vs Salaries Expenses

Salary payable and salary expenses both play a distinct role in the accounting procedure. Salary payable is a liability to the company, whereas salary expenses are treated as a payment in the accounting system. Professional bookkeepers can manage both the accounts excellently with their sharp bookkeeping knowledge and expertise.

Salary expenses reveal what employees are earning as salary. Salary payable is the amount of salary that the company has to pay to employees as salaries but has not yet distributed. On the other hand, the salary payable is treated as a proper financial transaction where salary expenses are merely a payment for the company.

How to record salaries

Salary is a crucial element of the business accounting process. Paying employees their salaries on time can significantly impact the company’s workforce and operational productivity. To perform the salary accounting accurately, here are a few tips you can follow as;

✔ Calculate Accrued Salary Expenses Correctly

The amount each employee will get must be calculated well before entering them into the accounting system. You need to do it on an accrual basis, which means on an advance. The need to calculate the amount you expect to pay your employees as salary in advance. You can calculate employee salaries based on the hours they work, or based on the pay rate, or anything.

✔ Record Salary Payment Completely

Document every move in the accounting journal accurately, following the accounting principles. Even if your business operation area is limited, you need to record everything completely. You can get accountants for small businesses to record salary expenses and salary payable accounting accurately.

✔ Update Your Books After Payroll Period

After the end of every payroll operation, you need to update your records accurately with the help of a proper accounting format. This will ensure your company records all information related to salary payment, updated and accurate.