Insurance data carries life. One mistake in recording insurance data can hamper the lives of many. Nowadays, using insurance data entry software is popular among insurance companies to reduce error percentages. But often, these companies face the dilemma of choosing the right software for their data entry work.

Let’s cut the chaos and guide you to choose the perfect insurance data entry software for your operation through this blog. If you run an insurance business, then welcome here. Try to get some quick and practical tips from here.

Challenges Insurance Companies Often Face Regarding Data Entry

Most commercial insurance providers follow a complex set of rules to handle their data. They have to handle a huge number of documents in their day-to-day operations. Recording each data manually is quite impossible in modern content where software is in operation.

However, using insurance data entry software has not improved the situation so far. Software can help to some extent, but most tasks have remained dependent on manual intervention.

A commercial insurance company faces the following challenges in its regular operations;

Overall, these challenges indicate that you need to choose software that can mitigate these.

Things you must check in your insurance data entry software

Software is being developed to solve challenges and ease operations. Earlier, insurance companies used to hire a team of data entry operators to record their documents. However, now the situation is different. The US insurance market is expected to grow to $ 2.54 trillion by 2030. This also means the capacity of the operation will increase.

To keep pace with the growth, you need to choose compatible software. The following things you need to check before selecting the right software for your operations.

Easy and Simple Data Management

Insurance companies handle a giant volume of data every day in their operations. They get documents through forms, online submissions, and emails. So, the software you choose must manage all these documents carefully. Nothing comes close to a simple and easy document management system to manage insurance data.

Support Collecting Online Documents

Nowadays, everything is online; thus, the insurance data entry software you choose must support online data collection. Therefore, you can collect documents from your customers without any hassle. They can submit relevant documents over your portal. On this side, the software will store all the documents in their respective places.

Seamless Document Creation

Generating quotes on time is essential for any insurance software. Insurance companies are always looking for tools or software that can generate quick quotes. Hence, you must check whether the software can create quick proposals or not before purchasing. You can quickly convert deals and minimize approval time when you select the right software.

Capture Electronic Signature

For insurance, it’s crucial to have your customers sign the relevant documents properly. Earlier, insurance agents used to visit insurers’ places to get the signed documents.

But now, the situation has changed due to online facilities. You can collect signed documents using the right insurance data entry software. The software must have the capacity to collect and verify signed documents. Apart from that, it must save all the signed papers in the storage securely.

Automate Workflow

Automation is no longer a far object rather it is the most connected thing that you can ever imagine. Automating workflow can save your productive business hours without any mess. Nowadays insurance software comes with automation benefits. Once you set the flow the insurance data entry software will perform all tasks one after another without your interruption.

Smooth Data Sharing Mechanisms

Insurance operations cover multiple departments and even sometimes cover different companies, if factors are included. Thus, smooth data sharing across the operational channel is non-negotiable in this matter. The software you select must provide a smooth experience in sharing information across different channels. Select the software that has intuitive routing tools to guide the data-sharing mechanism with other stakeholders.

Protect Consumer Data

Ensure that your insurance data entry software is taking care of your consumer data. Always keep your eyes on checking whether the software has accurate SSL, encryption, and compliance mechanisms or not. The software that covers all the matters is a green flag, and you must select that.

Principles insurance data entry software must follow.

GDPR

Consent from the customers is important for any insurance company to operate in the European Union. The software you use to moderate the insurance operation in the EU must follow the General Data Protection Rules (GDPR) strictly.

HIPAA

Health data is involved in insurance operations. Therefore, the software must follow the HIPAA guidelines strictly in order to provide the safety of the health data.

Options you have in insurance data entry software

Nowadays, various applications are there that insurance companies are using to manage their operation. But nothing can beat the following option when it comes to handling insurance data. The following applications are safe and easy to use. Let’s briefly go through each option here.

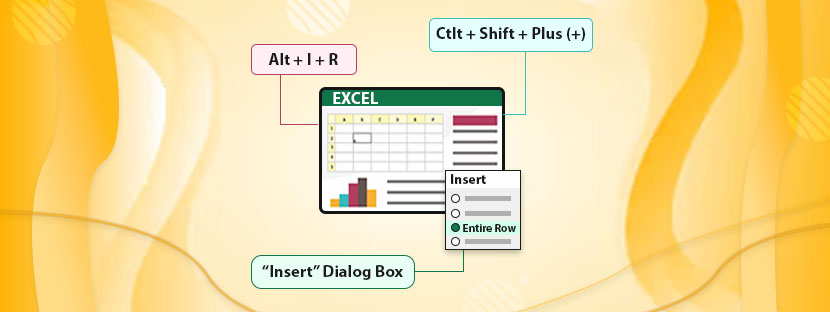

MS Excel

The oldest and the most popular platform is MS Excel, which is used to perform insurance data entry tasks. Performing tasks is so easy in this platform because of hassle-free and easy navigation. A variety of options are available in the software, which can help you to reach new heights with your data. Plus, it comes with different formulas to help you with data assessment.

Google Sheet

Like MS Excel, Google Sheets comes with similar options. The best part is that it allows your team to collaborate on the same sheet in real-time. Therefore, you can update your data on time without sending the sheet to your team member multiple times.

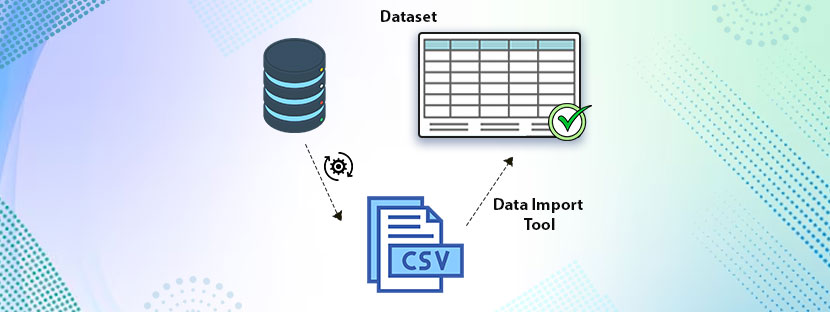

MySQL

MySQL servers can be counted as insurance data entry software for a very specific reason. That is, it can transfer your insurance data seamlessly without any errors. It also comes with exceptional optimizing features. You just need to fine-tune and make some little adjustments to get your SQL server ready for insurance data entry operations.