Do you know cashless payments across the world have increased over the years?

As per the Global Payment Systems Survey (GPSS), between 2017 to 2021, cashless transactions per person increased from 91 to 135.

So, how do companies cope with this huge shift?

The answer is transaction processing systems. They allow faster processing of payments and allow a smooth cashless experience. Let’s talk about this system in this blog.

What is a transaction processing system?

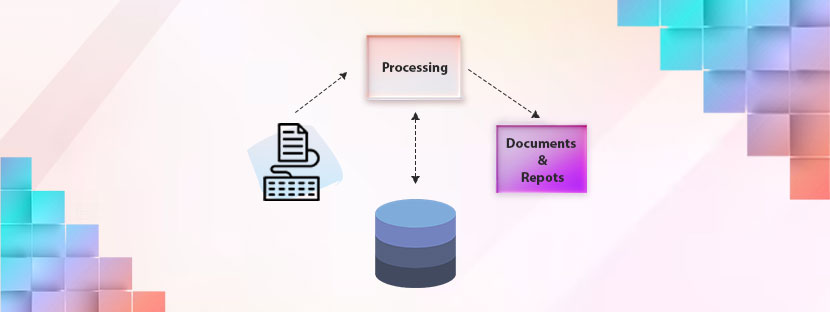

A dedicated transaction processing system (TPS) includes collecting, storing, modifying, and retrieving transaction data for a business enterprise. It works more like an information system that deals with transactional data.

Having a dedicated TPS ensures faster transaction receipt and processing. So, you may now ask why an organization needs such a system.

Well, it’s very essential to process customers’ orders on time and update inventory simultaneously. In due time, you also need to credit the seller’s account and arrange the payment order. The availability of payment methods is now wide, so checking whether payments are met or not, needs a dedicated system.

It’s important to note, that transaction processing systems are not similar to any sort of payment processing system. Payment processing, technically, is more complex and of course a different thing than transaction processing. It focuses on handling transactions but through banking routes only.

Whereas, on the other side, transaction processing does not have a direct participation in handling the transaction as it only manages customer and business data while and after making a transaction. Translation processing helps develop business intelligence and also aids in business analysis.

Benefits of Transaction Processing System (Examples)

Let’s have a closer look at where transaction processing plays a crucial role in updating transaction information in real time.

# Stock Exchange

Almost all stock exchanges across the globe have dedicated transaction processing systems that match orders between stock buyers and sellers. Plus, updating stock prices, stock information, and many other things in real-time.

# Bank & ATMs

ATMs or Automated Teller Machines that deal with bank transactions must have a transaction processing system. It enquires into balance details, withdrawal information, updated account balance, and so on.

# eCommerce Platforms

From receiving orders or verifying payment details to updating stock information, the transaction processing system performs everything. Big giants like Amazon, eBay, etc process all their orders, realize payments, and update inventory with the help of a robust transaction processing system.

# Airlines & Other Businesses

Airlines and other transport industries manage books via online reservation systems. So, with transaction processing, they easily can verify payment information, allot seats, send confirmation emails, and many other things. Ultimately, they can focus on improving user experience via a seamless booking system.

Elements of a Transaction Processing System

Mainly, there are 4 parts in this transaction processing ecosystem, which are;

Types of Transaction Processing System

1. Batch Processing

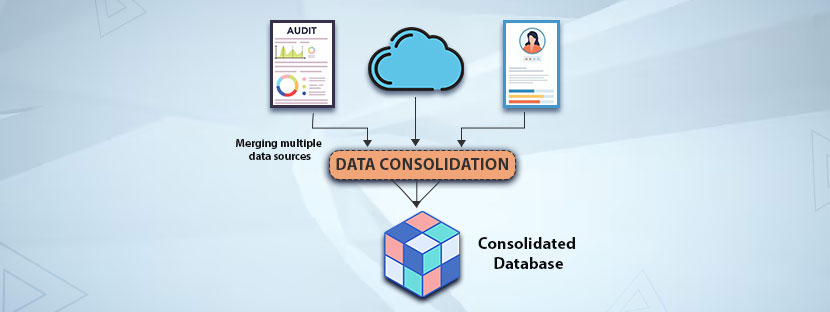

All transactions are processed in batches through this process. First, transaction data has been defined and segregated under different categories based on size, data types, and more. Later on, data admins take batches one after another to process them using the right methods and techniques.

Note: Batch processing doesn’t have time sensitivity matters, unlike the real-time processing ones.

What Types of Transactions Get Processed in Batches?

All transactions are processed in batches through this process. First, transaction data has been defined and segregated under different categories based on size, data types, and more. Later on, data admins take batches one after another to process them using the right methods and techniques.

Note: Batch processing doesn’t have time sensitivity matters, unlike the real-time processing ones.

What Types of Transactions Get Processed in Batches?

2. Real-Time Processing

Completely different from batch processing, real-time processing is time-sensitive. All transaction details must be updated immediately after receiving any response. Processing transactions in real-time needs technical capabilities and prompt response. For example, in eCommerce websites, admins process orders immediately after receiving the payment via the transaction processing system.

What Types of Transactions Get Processed in Real-Time?

Way Forward

A reliable method is essential to process transactional data on time. Many companies operating in the banking, stock exchange, airlines, or other industries outsource transaction processing services for quicker data process. For them, outsourcing saves costs plus makes the process faster. You just need a reliable company to delegate your transaction processing work.