✅ Follow the best practices of data furnishing to maintain the integrity and accuracy of furnished data

- Maintain up-to-date converted documents and data mapping procedure

- Track every measure to find risk and control measures

- Record policies and documents after performing every task

- Prepare process maps after the furnishing team processes the data

- Establish a data governance structure within the organization to monitor everything

Complying with the Fair Credit Report Act (FCRA) is a must for data furnishing. This is the first and important aspect of following data-furnishing measures. Right?

Accuracy of credit information also plays a vital role in the entire data furnishing measures. While furnishing customer data to Credit Report Agencies (CRAs), you need to take special measures for data security.

Consider your brand reputation and customer satisfaction when you begin the furnishing work, as a single mistake in the furnishing data can compromise customer information. So, it can damage your trust with your customer.

Following the best practices of data furnishing is the only way you can handle the credit information of your customers. Explore how these practices help and how you can maintain them in this blog.

Details of Data Furnishing

Let’s go with the meaning of “furnishing’ first. It means to showcase something in a particular order. In the same way, data furnishing means to provide or supply data to another party. Often, it involves sending data for legal purposes. It demands data transparency and compliance with certain types of rules and regulations.

Instances where you need to furnish data

- Companies furnish their financial data to government agencies to maintain financial transparency

- Financial companies furnish customers’ credit history to CRAs

- Businesses furnish their operational data to clients for building trust

Best Measures of Doing Data Furnishing

Following the best practices of data furnishing is important to ensure data integrity and accuracy in the credit information. Before you start doing the data furnishing, ensure that you have effective internal control over your data furnishing processes. Thereafter, you can follow these data-furnishing measures.

Outline policies and procedures for data furnishing

Structured policies and procedures showcase the effectiveness of a sound internal control structure. Having a sound internal control structure is absolutely important to manage data furnishing work. To establish a sound internal control structure, you need to lay down the outline of your policies and procedures for handling customers’ credit information.

Establish three-way reconciliation

Generally, you’re maybe comfortable with 2-way reconciliation to validate documents. But when it comes to validating customers’ credit information, you need to stay more alert. Three-way reconciliation is the best way you manage and validate customer data.

For you, it’s important to know what controls exist to ensure the number of records being submitted to CRAs, which are complete. Reconciliation between all three sources is important. These are

- Accounts on your servicing system

- Accounts generated on the Metro 2 file

- Accounts accepted by the CRA

Having a sync between these three accounts is important for the smooth management of data furnishing. Smooth reconciliation of data between these three sources can bring effectiveness to the entire data processing system.

Take quality in control

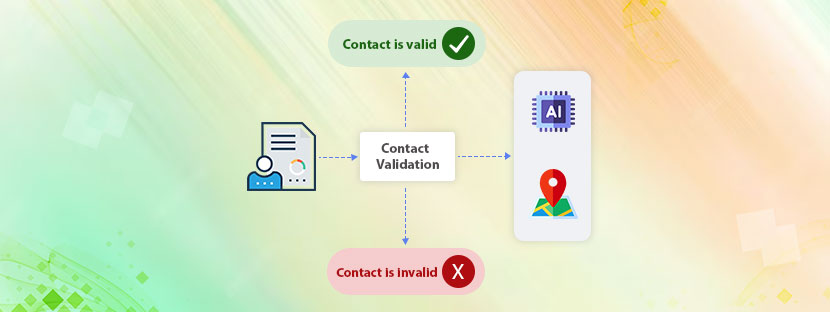

The data you put into the Metro 2 file must be accurate and valid. Best-in-class companies always focus on the accuracy and validity of their records uploaded to the Metro 2 file. They made this possible by following up on some simple processes.

First, they’ll evaluate the loan documentation

Seconds, they’ll confirm matching the sources

Thereafter, review the entire mapping

The entire system they follow is simple. They just compare the system field information to what is in the file, and then compare the results to the requirements outlined in the FCRA. You can follow the exact same way to have control over the quality of your data. Once you start following these practices, you’ll gain better control over your data.

At the final step, you need to obtain a soft pull of the tradeline from all CRAs and confirm it matches the Metro 2 file, and that’s it. Veteran furnishers also develop intelligent queries to get electronic data and then perform these types of testing as an end part of the data furnishing process.

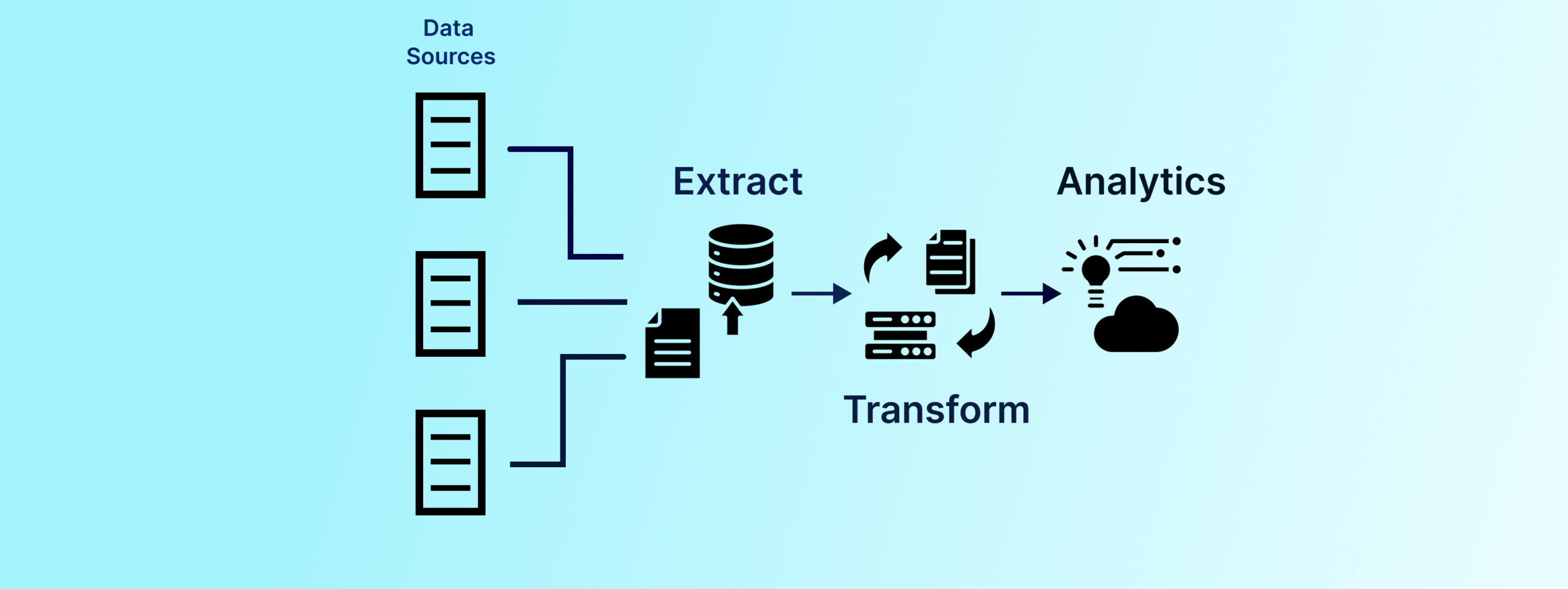

Perform data analysis

Prior to furnishing data to Metro 2, organizations must perform data analysis. It will reveal the potential inaccuracies and incompleteness of records. The whole point here is to assist companies in identifying issues with the Metro 2 files in advance. Initiating data analysis before data furnishing can show up invalid or retired values, missing fields, illogical conditions, and other issues.

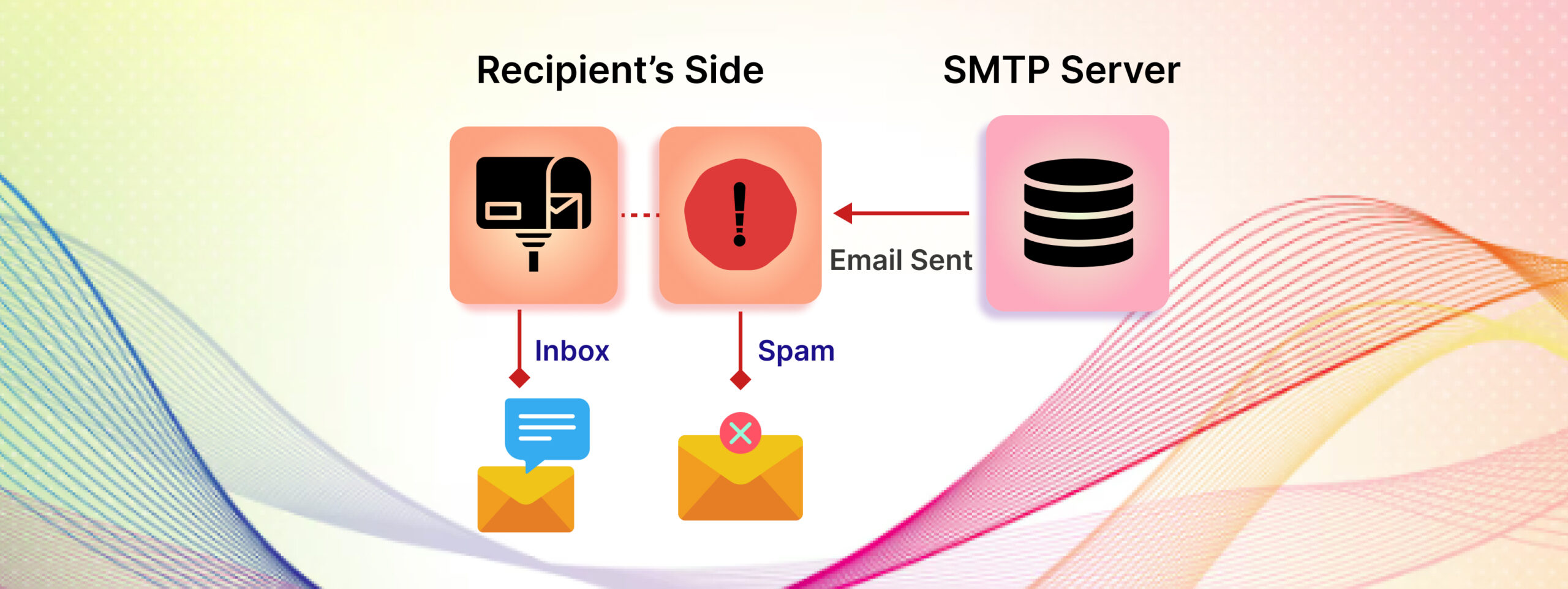

Manage reporting and oversight

Handling customer credit information demands adequate management of oversight, and reporting. During the course of furnishing data, you can interact with rejection, complaints, and imbalances with key performance indicators. But to effectively control the quality, you need to stay focused on reporting management. Controlling the quality is the prime element in this process. Thus, you need to focus primarily on the quality control aspect rather than any other matters.

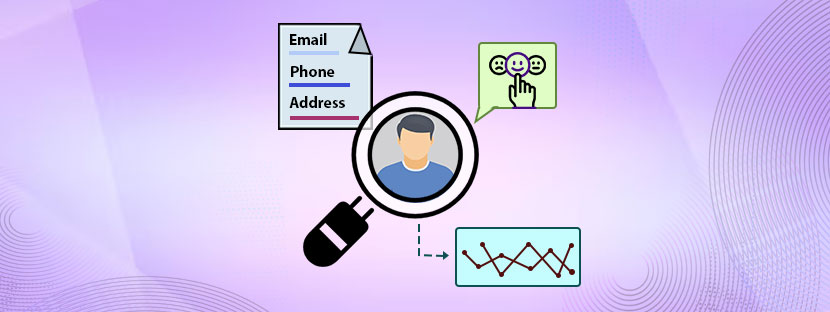

Upgrade your technology for efficiency improvements

As data furnishing is a critical thing to perform accurately. You need support from technology in this case. Having an upgraded system can help you get things done easily without creating any trouble. The system you’ll be using must support AI integration, OCR (Optical Character Recognition), appending & reverse appending, etc.

It’s always better to maintain data quality intact to handle data furnishing matters. Most of the financial organizations nowadays outsource to meet their backend needs. It includes recording and maintaining the financial records with accurate measurements.