In This Article

Expenses and liabilities are not the same!

Still, small businesses make mistakes between these two while doing the accounting. Thus, as a business owner, you must know the differences between expense vs liability accounts. This can help you manage your accounts more accurately.

This article will clarify all your doubts regarding expenses and liability accounting and explain to you how to manage your accounts with a clear insight. We will also talk about debts and how to account for them in this piece.

Let’s get started!

What is a liability account and its types?

Let it be very clear, liabilities are not expenses. Liabilities and expenses both share different characteristics and different accounting treatments. Liabilities are basically the obligations that your company owes.

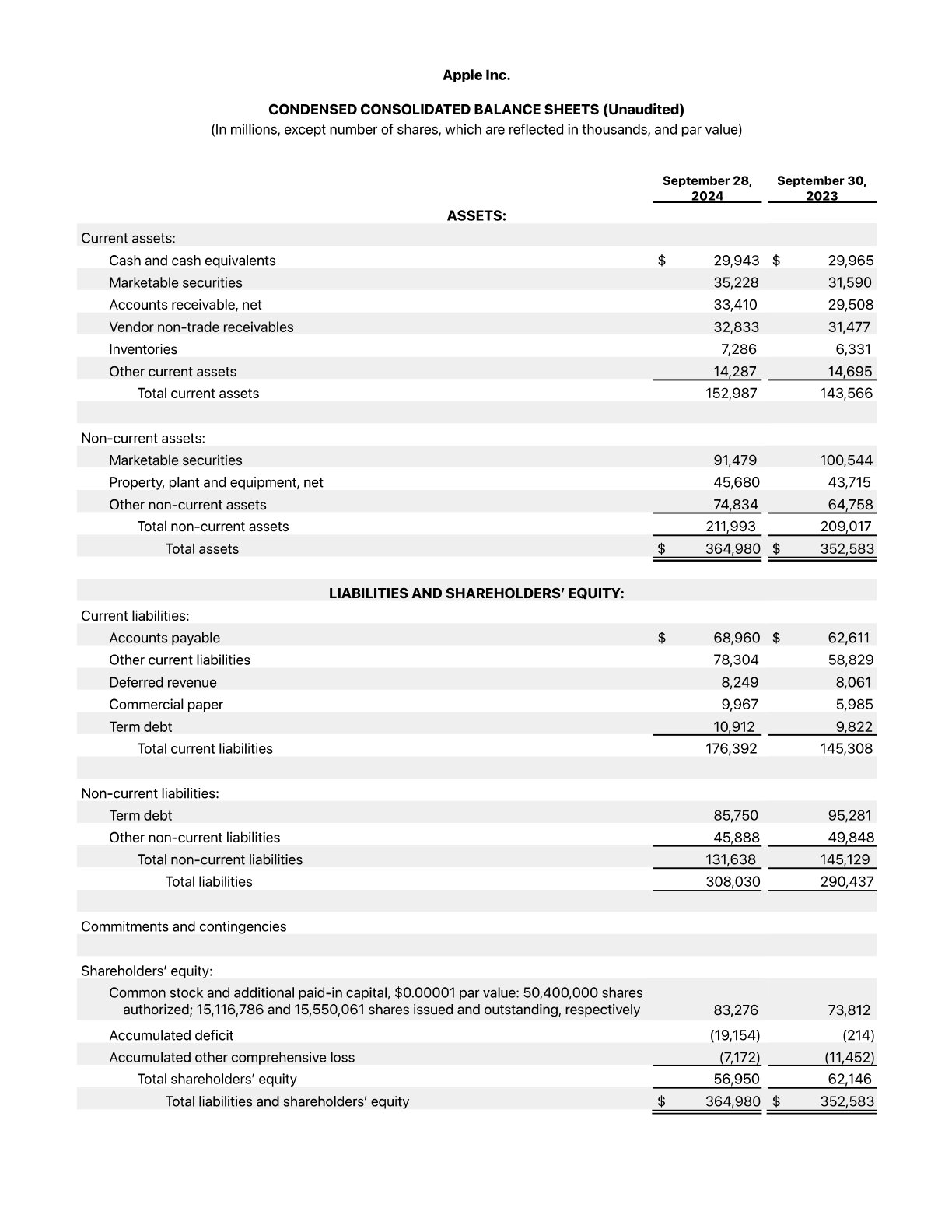

Liabilities get a special position in the balance sheet as well as in the financial statement. These are obligations or some sort of debt that a business must pay in the future. These obligations can arise from the services the business received but not paid for, or any kind of loan, etc. The ability of the company to meet these obligations showcases the financial and strategic strength of the company.

Liability Types

Current Liabilities

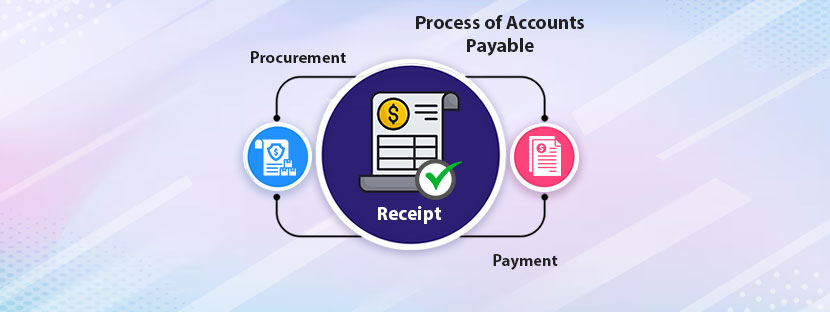

Current liabilities, too, are not expenses. The term ‘current’ defines “short-form” here. Therefore, current liabilities indicate short-term obligations, which are being paid with current assets. Current liabilities include;

- Accounts payable

- Income tax payable

- Accrued compensation

- Accrued wages

These liabilities are paid with current assets, which include cash, accounts receivable, liquid assets, etc. Remember, debts (maturing within 1 year or less) will also come under current liabilities.

Non-Current Liabilities

Long-term liabilities are accounted for under non-current liabilities. These liabilities are getting paid with fixed assets. Usually, these liabilities are not paid immediately; rather, the term ‘long-term’ is associated with this for this purpose. Non-current liabilities include;

- Mortgage debt

- Bonds

- Loans with over one-year maturity

Long-term liabilities are paid with fixed assets like equipment, non-liquid assets, equity, investment, etc.

FAQ

Are accrued expenses current liabilities?

Accrued expenses are those that have been incurred but not paid yet. So, from an accounting perspective, these expenses are liabilities. They usually come under the current liabilities section. These expenses are typically due within one year or less.

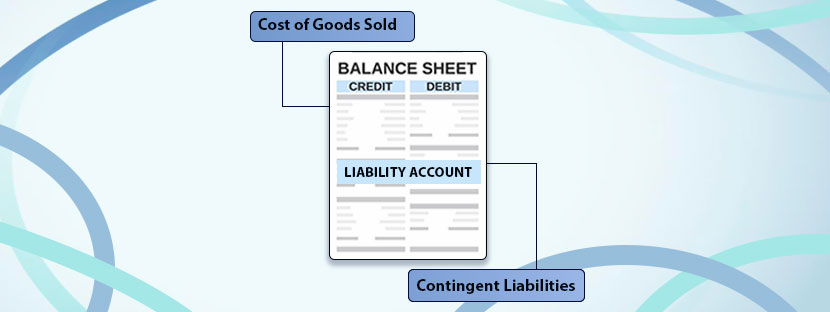

Contingent Liabilities

A contingent liability is like a potential liability that may or may not occur and depends on an uncertain future event. It’s basically an accounting estimate where the probability of the contingent situation determines the liability amount. Determining the amount of contingency is also a step-by-step process. It covers guarantees of debts, liquidated damages, government probes, and lawsuits.

What is an expense account and its types?

To earn revenue, businesses incur costs, which are for running regular business operations. These costs are expenses. Mainly, the cost of resources consumed to earn income is an expense. These are not obligations that businesses need to pay after a certain time, unlike liabilities. Businesses must pay all the expenses immediately to earn revenue.

Expenses Types

Cost of Goods Sold (COGS)

COGS is not a liability, it’s a combination of expenses. It includes the cost of raw material, overhead costs, labor costs, and costs that are associated with direct production. Paying off these expenses is a must in order to keep the production run.

Administrative and General Expenses

Besides running the production, businesses must manage administrative operations smoothly. For this, they made expenses, which look similar to these;

- Commission

- Insurance

- Advertizement

- Subscriptions

- Employee benefit programs

- Rent

- Professional fees

- Payroll taxes

Well, the list is quite large and it includes all other charges that help businesses run operations.

FAQ

Which category of taxes comes in – a liability or an expense?

Both. Taxes come under expenses when they are incurred and then shifted to liability when they are paid.

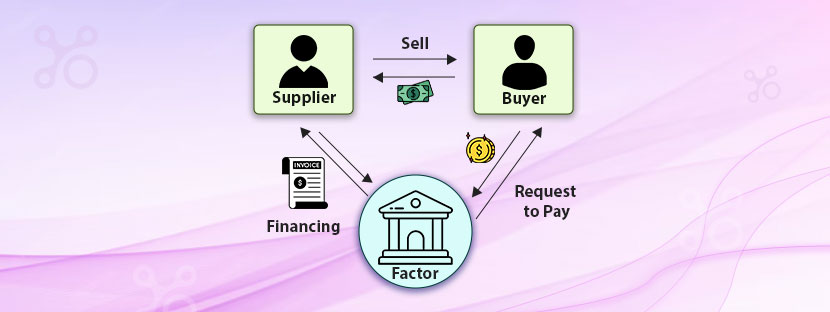

What is debt, and its types

Understanding the concept of debt is important when you differentiate between expense vs liability account. Debts are basically the money you owe to another party, specifically the creditors. Mostly, creditors lend you goods, services, and investment in exchange for interest.

Types of debts

A business generally faces the following types of debts;

- Mortgage

- Personal loan

- Auto loans

- Credit card activities

Accounting has some measures to manage the placement of debts. Debts are usually placed on the liability side of the balance sheet.

Expense vs liability account vs debt: an overview

| Aspect | Liabilities | Expenses | Debts |

|---|---|---|---|

| Placement | Getting placed in the Balance Sheet | Getting placed in the Income Statement | Getting placed in the Balance Sheet |

| Duration | Short-term as well as long-term | Usually short-form, but can be extended | Usually long term |

| Examples | Accounts payable, accrued wages | Salaries, rent, etc | Mortgage, Loans, etc. |

| Paying time | Paid at a future date | Paid immediately | Paid on a future date with interest |

| Accounting procedure | Treated as a credit and gets offset with a debit account | Treated as a credit and offset with the cash or bank account | Similar as liabilities |

Why differentiate between expense vs liability account is important for small companies?

For startups or small businesses, it’s commonly observed that they run with a negative cash flow or with a loss. It happens primarily because they make a mistake identifying expenses with liabilities. Due to this, often their equity funds get used to meet expenses, which weakens their financial strength over time.

With the help of professional bookkeepers, small companies and startups can manage their finances well. They help startups and small companies manage their accounting information accurately. Luckily, their expertise can save businesses from mixing up expenses with liabilities.

In order to survive for a long period, startups and small companies need to stretch their initial equity and debts as much as possible. Adding up expenses as liabilities at this point can decrease the equity level. Hence, they need some expertise to deal with it. A professional bookkeeper will make sure that expenses and liabilities are recorded in the right place at the right time. You can get professional bookkeepers via outsourcing.