Accounts payable (AP) plays a critical role in cash flow management. It reflects the amounts a business owes its suppliers for goods or services received but not yet paid for. Often, businesses notice an increase in accounts payable year-over-year but find a negative impact on their cash flow statement.

This paradox may initially seem confusing, but it has a logical explanation grounded in accounting principles. Let’s dive into why this happens and how it impacts a company’s financial outlook through this trade payable explanation blog.

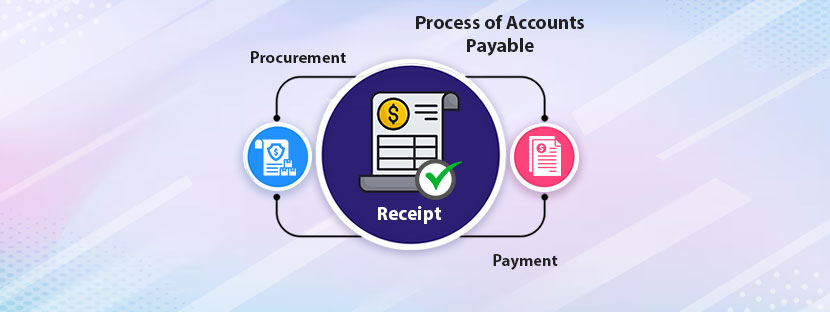

Understanding Accounts Payable and Cash Flow

Accounts payable or trade payable represent short-term liabilities on the balance sheet. It indicates the money a business owes to vendors or creditors. An increase in accounts payable means the company has delayed payments to its suppliers, effectively holding on to its cash longer.

The cash flow statement, on the other hand, provides insight into how cash moves in and out of the business. It categorizes activities into operating, investing, and financing sections. Trade accounts payable directly impact the operating activities section of the cash flow statement.

Why an Increase in Accounts Payable Can Appear Negative

An increase in accounts payable usually signifies that the company deferred payments to conserve cash. However, in the cash flow statement, the interplay between accrual accounting and cash movements can show a negative impact. Here’s why:

Timing Differences

Accrual accounting records expenses when incurred, not when paid. If accounts payable increased, expenses were recognized but payments were deferred, reducing cash flow.

Offsetting Cash Outflows

The increase in accounts payable might not offset other cash outflows. For instance, higher expenses elsewhere could overshadow the cash conserved through delayed payments.

Impact of Non-Cash Adjustments

Non-cash items such as depreciation or amortization, which also appear in the cash flow statement, might further distort the net impact of accounts payable.

How Accounts Payable Affects Operating Cash Flow

Accounts payable is a key component of working capital. Changes in accounts payable directly impact the operating cash flow. Here’s how:

Positive Impact: When trade accounts payable increase, it temporarily boosts cash flow since the company is holding onto its cash longer.

Negative Impact: When accounts payable decrease, it means the company pays off its liabilities, causing a cash outflow.

For example, if a company’s accounts payable grow by $50,000 in a year, it retains that cash instead of paying it out. This increase typically results in a positive adjustment in operating cash flow. However, when combined with other factors like declining revenues or increased operating expenses, the net cash flow could still be negative.

Scenarios Where Accounts Payable Increase Shows Negative Cash Flow

Scenario 1: High Operating Expenses

If operating expenses rise significantly, the increase in accounts payable may not cover the overall cash outflow. This leads to a net reduction in operating cash flow.

Scenario 2: Reduced Receivables Collection

When accounts receivable collection slows down, cash inflows decrease. Even with higher accounts payable, the overall cash flow might still be negative.

Scenario 3: One-Time Large Payments

A business might defer payments temporarily by increasing accounts payable. However, if a significant one-time payment is made during the year, it could outweigh the benefits of deferred payments.

Scenario 4: Non-Cash Adjustments

Non-cash expenses like depreciation reduce net income but not actual cash. This interplay can create a situation where accounts payable increase but cash flow remains negative.

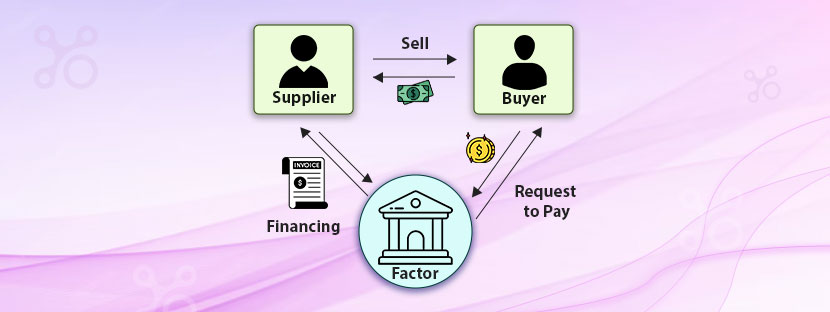

The Role of Strategic Management

Managing accounts payable effectively is essential for maintaining healthy cash flow. Companies must strike a balance between taking advantage of supplier credit terms and ensuring timely payments to avoid penalties or strained relationships.

Tips for Managing Accounts Payable

Importance of Context in Cash Flow Analysis

Understanding why accounts payable appear negative requires a broader context. Evaluating other components of the cash flow statement is crucial. For example:

When to Worry about Negative Cash Flow

Negative cash flow isn’t always bad. It’s a concern if it stems from declining revenues or poor financial management. However, if it results from strategic investments or temporary issues, it might not signal trouble.

Indicators of Concern

- Consistent negative cash flow over multiple periods.

- Rising liabilities without corresponding revenue growth.

- Inability to cover short-term obligations.

Conclusion

Accounts payable plays a pivotal role in cash flow dynamics. An increase in accounts payable can sometimes appear negative in the cash flow statement due to the interplay of accrual accounting and cash movements. Understanding the underlying reasons is crucial for accurate financial analysis.

Businesses can optimize cash flow and ensure long-term stability by managing accounts payable effectively and considering the broader financial context. Monitoring these metrics regularly will help in making informed decisions that drive growth and sustainability. At AskDataEntry, we take special care of accounts payable processing through our extended services. Try us, delegate your AP processing today.