If you’re using software for accounting, recording accounts payables balance sheet entries accurately is crucial for you. These entries will leverage your software to automate invoice processing.

Accounts payable gets placed in the balance sheet under current liabilities. It’s treated as a liability that the business owner has to pay off within a certain time. Optimal management of accounts payable can improve and optimize cash flow operations.

Let’s check here on how accounts payable entries are being recorded in the balance sheet in a comprehensive manner. We’ll also measure the importance of positioning accounts payable in the balance sheet in this blog.

Get started!

What is a Balance Sheet

A balance sheet is a financial statement document that reflects the financial position of a company at a specific point in time (usually at the end of the year). It’s a reflective document where the net worth of the company is revealed. Besides net worth, what the company owes and owns, a balance sheet statement covers everything.

The formula that builds up the balance sheet is “Assets = Liabilities + Equity”

Explaining Key Components of a Balance Sheet

Assets

The difference between total assets and liabilities is equity. It’s also known as the net worth of the company. It includes retained earnings, shareholders’ equity, and other invested funds in the company. In a balance sheet, equity is added to the liabilities to become equal to assets.

Position of accounts payable on the balance sheet

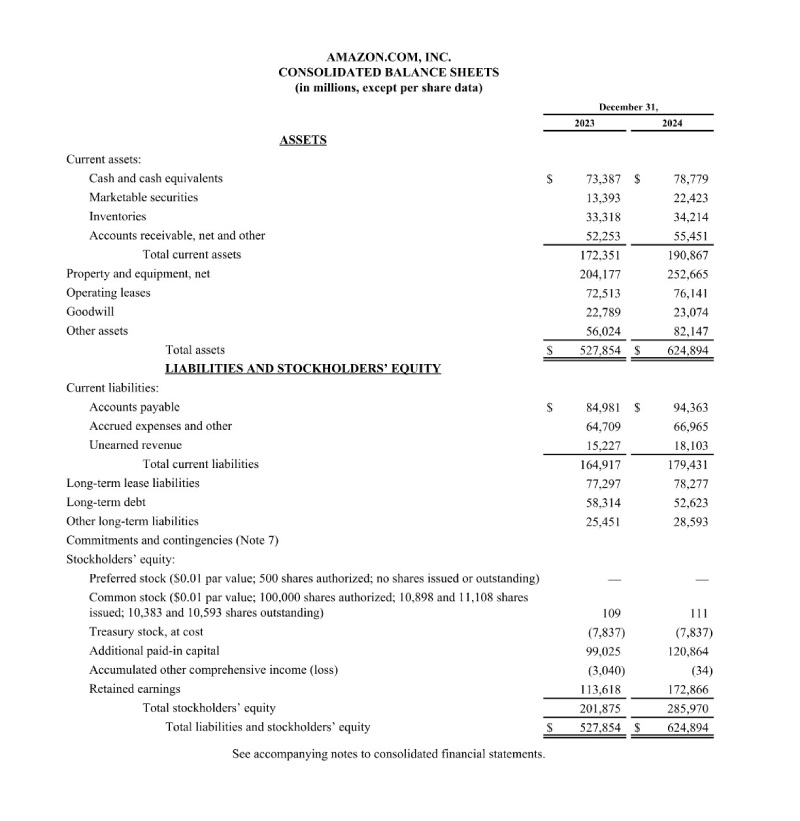

Accounts payable come under the liabilities section and are placed under the division of current liabilities.

Figure: Consolidated Balance Sheet of Amazon.com Inc. 2025

Importance of positioning accounts payable on the balance sheet

Accounts payable represent the current or short-term liabilities and the ability to manage cash flow. Businesses put accounts payable information in the balance sheet to check the business’s ability to meet its obligations in real-time. However, many other reasons are also there to fix the position of accounts payable on the balance sheet, which are;

Liquidity Assessment

Accounts payable represent short-term liabilities. Posting accounts payable information to the balance sheet can boost your stakeholders’ confidence. Because they can check the ability of the company to meet the dues on time.

Vendor Relationship

Recording accounts payable information to the balance sheet accurately is a part of accounting practices. When you do it perfectly, it will provide a positive impact on the vendor relationship. This will also ensure the extension of the partnership and favorable payment terms.

Financial Analysis

To calculate critical liquidity ratios, the assessment of accounts payable is important. Financial analysts can get all the information regarding your financial matters once you publish your balance sheet. So, an accurately managed balance sheet can help you get the right analysis.

How do account payables balance sheet entries get reported

As shown before, the position of accounts payable is under the current liabilities section of the balance sheet. The position is significant as it helps stakeholders to understand the company’s ability to meet short-term obligations. It also signifies the stronghold of the company’s cash flow operations to meet vendor payments. In the balance sheet, the position of accounts payable at the end of the year is reported.

Facts about accounts payable appeared in the balance sheet

- Accounts payable must always have a single line appearance in the balance sheet. This represents the total amount owed to suppliers for goods and services received, but the payments have not been made yet.

- Ratios like current ratio, quick ratio, and other liquidity ratios are being calculated using this accounts payable data.

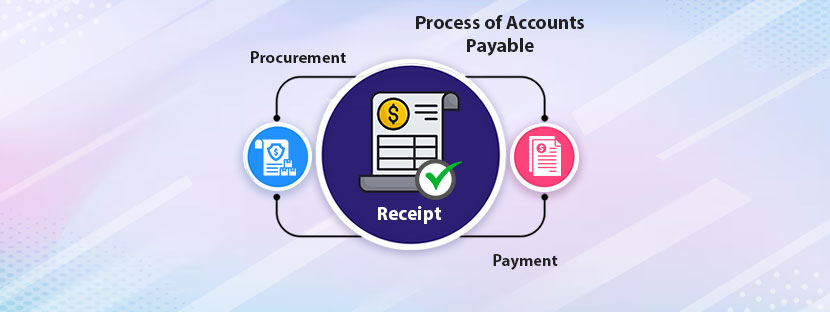

What Accounts Payable Balance Sheet Entries Include

Accounts payable represent the dues that businesses have to pay. When recording the AP data to the balance sheet, the following business obligations businesses need to consider;

Supplier Invoices: Businesses need to pay the supplier invoices on time when they purchase inputs or raw materials on credit.

Subscriptions: Recurring payments for services in the form of subscription fees are calculated under accounts payable. Service providers invoice them later, after delivering the services.

Utility Bills: Monthly bills due at the end of the month come under accounts payable calculations. It covers bills for electricity, phone, internet, water, etc.

Contractor Payment: Businesses always sign deals with external contractors to get services like insurance, IT support, and security. Therefore, payment for these contractors is getting calculated in the accounts payable section.

Professional Charges: Professionals like lawyers, consultants, accountants, etc, need to be paid on time for their services. All calculations are made under the accounts payable section.

Maintenance: To keep equipment at the optimal level, maintenance charges are included in accounts payable.

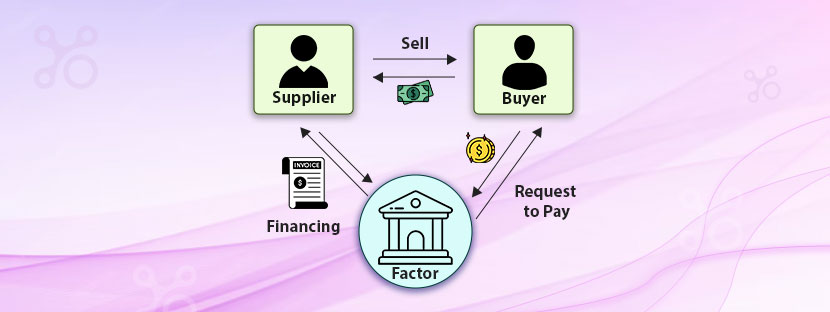

Automate AP with Bookkeepers’ Support

Accurate bookkeeping can save your business from making heavy mistakes. That’s the reason why businesses still hire bookkeepers to manage accounts payable work. Even if you can automate your accounts payable system but you still need support from bookkeepers. They can help you record your entries at the right location in the balance sheet as well as in the accounting system.

While using software can help you reduce your time and on the other hand, real bookkeepers will validate each accounting information before posting it. With the help of automation and manual combination, you can manage your accounts payable information accurately.