In This Article

Putting invoice numbers one after another is not just a monotonous task but it takes a longer time to do so manually. The introduction of the OCR invoice processing technology revolutionized the entire working pattern. It has become an integral part of the modern Accounts Payable (AP) workflow.

At present, every AP software has its integrated automated invoice processing system. It helps to extract invoice data automatically from digital documents. Overall, the need for recording data manually has reduced but still, the need for manual verifications is there.

Let this blog help you understand OCR for invoice processing systems in detail. We’ll explore how invoice processing works and what advantages it provides. So, get started!

What is Invoice OCR

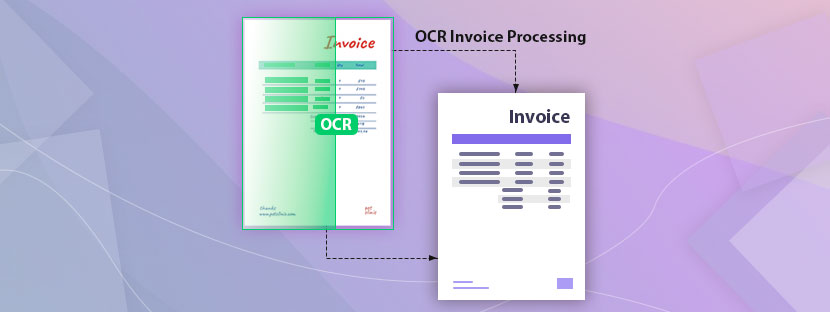

Invoice OCR is the way to extract data preferably from digital documents like invoices. After extraction, it converts the data into editable and searchable text format. The Optical Character Recognition (OCR) technology scans read-only documents to extract information and convert that information into editable text format.

How OCR Invoice Processing Works

OCR automates the data-extracting process. Earlier data entry professionals used to put data into the AP system manually. Now, the OCR invoice scanning system automatically puts data from PDFs and other financial documents into the AP database. The best part of OCR is it captures data from financial documents and converts it into pure information, that too in real-time.

Let’s check how OCR Invoice Processing works in this step-by-step analysis.

Step One – Scan & Upload

Nowadays, most transactions happen in paperless modes. So, whenever an organization receives any invoices, the first task is to upload the invoice into the system. The OCR-enabled software and OCR billing help system will scan the document and store the data in the system.

Step Two – Image Processing

Now in the case of paper invoices, the software will make arrangements to improve the quality of scanned images. It involves enhancement of the image, color correction, angle correction, noise removal, and so on.

Step Three – Recognizing Texts

OCR Invoice Processing is a super-intelligent technology where textual data gets scanned and recorded. Well, sometimes machines make errors while scanning text data, especially from poorly visible documents or handwritten texts. So, manual verification through OCR services is needed here.

Otherwise, the system extracts the following details from invoices;

- Invoice date

- Due date

- Payment information

- Discount details

Step Four – Data Verification & Validation

Once the data is stored in the database the main task begins. The software may include all the information in the system but is unable to ensure complete accuracy of anything. Here you need some manual intervention to check and validate each data you put there. Some degree of human expertise and skills are needed to ensure proper validation of invoices.

There is nothing better than manual verification. The extracted information must be validated on time. Human operators review and validate each piece of information with specific details and make necessary adjustments if needed.

Step Five – Export Data

After the verification phase, finally comes the last phase, which is data exporting. Here, the data directly gets into the ERP (Enterprise Resource Planning) system for further payment and processing.

Advantages of OCR Invoice Processing

OCR for invoice processing enhances AP analysts’ efficiency by automating invoice data entry, ensuring zero manual errors, and saving costs. It ultimately improves accuracy in accounts payable and ensures timely payments.

Enhanced efficiency

OCR technology drastically reduces the need for manual data input, allowing your team to focus on strategic tasks like financial analysis or vendor negotiations.

Accelerated invoice processing

Manual systems are limited by human resources, which can slow down invoice processing as your business grows. OCR can quickly process large invoices, ensuring on-time payments and improving vendor relationships.

Reduced error risk

Even experienced AP professionals can make costly errors. OCR minimizes the risk of issues like duplicate payments, transposed values, overpayments, lost invoices, late fees, or missed discounts. Overall, strengthens the entire operating system.

Significant cost savings

By automating invoice processing, OCR reduces the need for additional headcount and allows your company to scale without adding labor costs. Additionally, timely payments help you avoid late fees and take advantage of early payment discounts.

Improved compliance

OCR for invoice processing ensures accurate record-keeping, which is essential for compliance with financial regulations and tax laws. Filing tax documents and other financial papers will be easier once the OCR is integrated into the system.

Improved accuracy

OCR invoice scanning captures invoice data with high accuracy, reducing discrepancies and ensuring that your financial records are precise, which is crucial for maintaining visibility into cash flow and overall economic health.

Integrate OCR into Accounts Payable Workflow

Integrating an OCR-based accounts payable management system could be your best decision if you follow a proper implementation plan. Let’s frame a proper strategic plan to integrate OCR billing help into your workflow here.

First thing first, select the right software

At present, you can have different types of software available in the market. Every provider is offering exciting features and exclusive benefits. However, you need to set your expectations from the software and then get a suitable one for your operations. You can opt for cloud-based options for easier access and deployment.

Next, prepare invoices

Ask your vendors to send invoices in any standard format, preferably in PDFs. Even if they are unable to send invoices in any standard format, you need to set up a system to standardize all invoices. Thus, your OCR invoice processing can be completed with less friction and quickly.

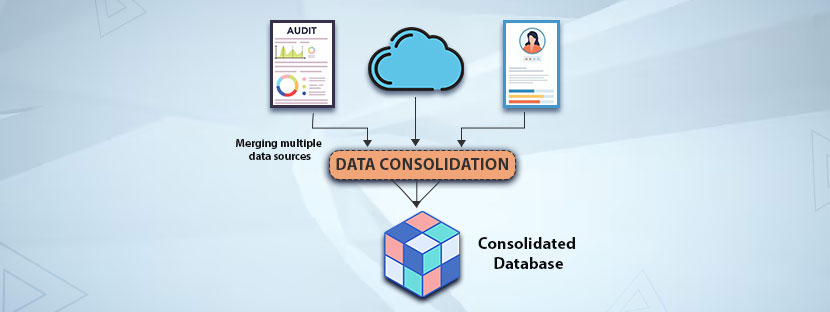

Remember, you have to prepare the storage system as well. A centralized repository is fine as you can connect it with the cloud system and share access to multiple ends. Plus, all invoice data will get stored here but you need to keep checking on duplicate data issues.

Train your team and review performances

Use any template invoice to train your team initially with the OCR invoice scanning system. Let them understand how the system works and learn all terminologies. After training, review their performance and check what things go well and what is wrong. Finally, implement good practices and address the mistakes through organizational learning patterns.